THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES FOR MORE INFORMATION

Meet your investing goals and avoid the hype by getting back to these 5 stock market basics.

As an investment analyst for large banks and a venture capital firm, I’ve seen my share of stock-picking strategies. Wall Street loves to complicate investing because…well, it keeps individual investors thinking they need to pay high advisor fees and brokerage commissions.

The truth is it’s the basics that make money and will help you meet your investing goals.

I use just eight basic rules to invest my own money. They range from the obvious like starting an investment plan early and getting all the free money you can with tax-deferred retirement plans to others that aren’t so widely followed.

In fact, there are five stock market basics that I see investors constantly ignore.

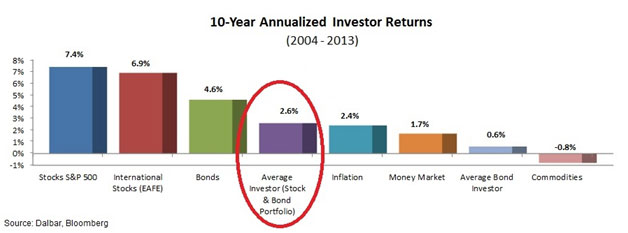

It’s a big part of the reason why the average investor made just 2.6% annually on a stock and bond portfolio over the decade to 2013. That’s despite stocks earning 7.4% annually and even bonds providing a 4.6% annualized return over the period.

I won’t claim outstanding double-digit returns by following my short list of stock market basics but I’ve done a lot better than 2.6% and I’m well on my way to reaching my investing goals. Following the basics below means I don’t have to worry about a stock market crash and won’t fall for all the schemes that lose money for most investors.

Table of Contents

The Five Stock Market Basics to Follow to ‘Beat the Market’

Everyone wants to ‘beat the market’. Turn on CNBC for five minutes and you’ll get at least five stock picks to make you rich.

Beating the market isn’t about double-digit returns. When the average 55 – 64 year old has just $104,000 set aside for retirement, beating the market may be as simple as meeting your investing goals with a market return.

Following these five investing basics won’t make you rich but they will help to beat the average investor return and avoid some of the worst investor behaviors that lose money.

#1. Stop Losing Money On High Commissions And Trading Fees

Even on a $50,000 portfolio and a budget brokerage account, making just four trades a month can cost upwards of $480 annually and reduce your return by nearly a percent. Try investing in a diversified portfolio of 20 stocks, buying more of each stock every quarter and you’ll be making 80 trades a year!

Save money with investing funds like exchange traded funds. The funds give you exposure to hundreds of stocks with one purchase so you don’t need to buy lots of individual stocks to reduce risk. Deposit money in your investment account each month but wait to invest quarterly or even every six months. You’ll save hundreds on investing fees and likely aren’t going to miss out on any spectacular market runs.

#2. Don’t Super-Size Your Portfolio

Just about any broker will let you borrow money to invest in stocks. It’s called investing on margin and seems like a good way to boost your returns. Even at fairly high rates of 7% to 10% on borrowed money, you’re out ahead if you can make a higher return…right?

The problem is that investing on margin also boosts your losses when the market tumbles. Borrow $1,000 on a $1,000 account and that 15% loss on a market correction becomes a full-blown 30% nightmare plus the interest you pay. Worse still is that investors have a tendency to freak out and sell when they see big losses, locking in the pain from a bad margin bet.

#3. Diversify Across Different Asset Classes

Everyone talks about diversification, the idea of investing in different assets and stocks from different sectors so that you spread risk across many different investments. The fact is that many investors are almost completely invested in stocks and limit their portfolio to just a few ‘hot’ stock picks.

Make sure you are really spreading your money across different stocks, bonds and even alternative asset classes like peer lending investing. Bonds and peer loans won’t tumble when the stock market swoons because they are financial obligations. Don’t forget to invest across different stock sectors as well. Using just one screening strategy like high dividend yields can leave you dangerously exposed to just one or two groups of stocks.

#4. Investing Is About YOUR Goals Not About Picking Stocks

Why are you listening to a hundred stock market pundits on TV talk about double-digit returns? Who is going to suffer if you miss your investing goals? Understand the return you need to meet your investing goals and the amount of risk you can tolerate in your investments. Invest according to that, not some arbitrary target for return.

There is nothing wrong with aiming for a modest 5% return on a diversified portfolio of stocks and bonds if that is all you need. Don’t reach for too much risk if you aren’t comfortable with big swings in your nest egg and if it’s not what you need.

#5. Investing Is About What You Put In

Too many investors think investing is about making big money on stocks and then get disappointed when their portfolio doesn’t grow fast enough. Even on a market return of 7.4%, a portfolio of $50,000 is going to add less than four thousand in a year.

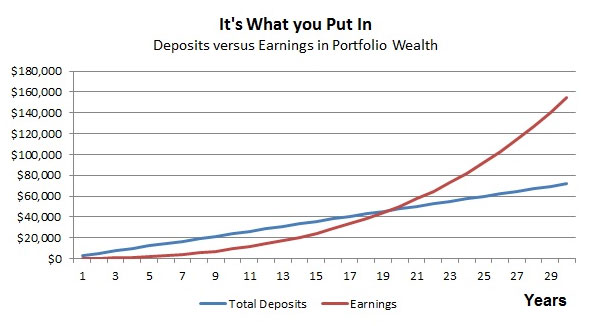

Investing is much more about your regular deposits than it is about scoring big returns. The graph below breaks a portfolio into two parts, total deposits and the money earned on those deposits.

It takes nearly two decades for your earnings to catch up to regular monthly deposits. In fact, on the average market return, deposits will still be about a third of your total portfolio value after 30 years. Neglecting a consistent savings plan risks missing your goals with a much lower nest egg.

Final Thots

These may seem like overly-simplistic investing rules but that’s the point. Follow just these five investing basics and you’ll avoid the biggest mistakes made by investors. You’ve got enough to worry about, don’t make investing any more difficult than it has to be.

Author Bio: Joseph Hogue, CFA is an investment analyst and runs six blogs including PeerFinance101 and MyStockMarketBasics. He holds the Chartered Financial Analyst (CFA) designation and lives in Medellin, Colombia with his wife and son.

[Photo Credit: Raymond Sam]