THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES FOR MORE INFORMATION

When the market drops suddenly, it is called a stock market correction. It can be a scare time for investors to see a portion of their wealth wiped out in a few days. But there are some important things to know about a stock market correction.

In this post, we will look in detail at this event and how you can get through one without making the major mistake of selling out of the market.

Table of Contents

How To Survive A Stock Market Correction

What Is a Stock Market Correction?

A stock market correction is when the stock market drops by 10 to 20%. Throughout history, corrections happen frequently. Some research reports that corrections happen every 2 years on average.

The most recent correction was back in February 2018. If you remember, the market was hot in January and then one day in February it tanked. Then it was extremely volatile for the next few weeks. It was a crazy time.

With a stock market correction relatively common and scary time, how do you survive a correction? Here are a handful of tips for surviving a correction and coming out the other side with your nest egg intact.

#1. Set Up An Opportunity Fund

You cannot time the market. No one knows when the stock market will rally or decline. But you can take advantage when prices do drop. Set up an opportunity fund.

This is a cash account that you save money into over time, allowing you to take advantage of opportunities when they present themselves to you.

If the market drops by 10%, you could take some of this money and put it in the market. There are many uses for an opportunity fund, so having one is a good idea.

Just understand that you are better off investing on a regular basis as opposed to trying to buy on the dips.

#2. Stay Consistent

As I mentioned above, you can’t time the market. The best thing you can do is just invest systematically over time. Dollar cost averaging is a great way to do this.

By dollar cost averaging, you invest a set amount of money each month in the market. You buy regardless what the market is doing.

Over time, you come out ahead as the long-term trend of the market is positive.

The easiest way to start a dollar cost averaging plan is to begin investing with a robo-advisor. Why do I say this?

With robo-advisors, you spend 10 minutes setting up your account and they do the rest for you. When setting up your account, you decide on a monthly amount to invest and they will automatically invest your money, rebalance your portfolio and more.

It really is the simplest solution for most investors.

Now, choosing a robo-advisor can get confusing since there are so many out there. My favorite is Betterment. They are one of the originals out there and have a solid plan to help you grow your wealth.

Click here to start investing with Betterment.

#3. Turn Off The TV

The media loves to play with your emotions. That is why they use sounds, colors, and pictures to get you emotionally involved in the stories.

The more eyeballs they have watching or reading their stories, the more they can charge advertisers, which means the more money they make.

So blowing things up out of proportion is in their best interest, not yours. In fact, this is one of the stumbling blocks of both beginning and veteran investors.

Your best bet is to turn off the television and tune out the noise as I call it. The more you can do this, the less urge you will have to involve your emotions when it comes to your investing. Investing and your emotions do not work together. But how do you keep your emotions in check?

#4. Know The Facts

Knowing the facts goes a long way in keeping your emotions in check. If you re-read the beginning of this post, you know that a stock market correction happens fairly often. This knowledge is powerful.

When you hear the news talking about a correction, you know that the market will drop about 10-15% and you can move on.

There is nothing to worry about because this happens all of the time. It’s like a rainy day. It’s bound to happen at some point. It’s not fun when it does happen, but you know that it won’t last forever.

#5. Focus On The Long-Term

The stock market doesn’t just go up forever. Likewise, it doesn’t just drop forever either. Over the short-term however, it can feel like the stock market does either one. Know that you need to focus on the long-term. Over the short-term, the stock market is choppy.

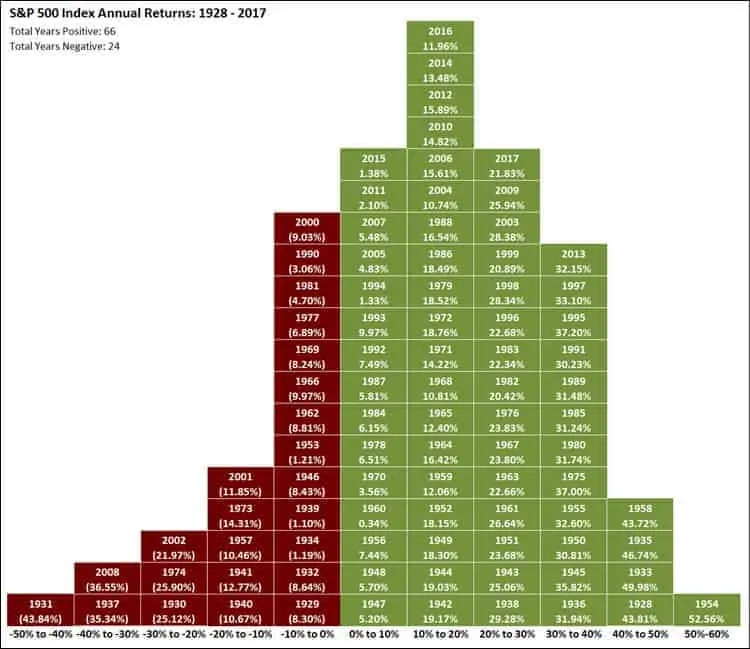

It bounces higher and lower all of the time, which tests every investors nerves. But over the long-term, the market rises. See below for proof.

Yes, there are years when the stock market loses money, but more often than not, it moves higher. But to grow your wealth when investing, you have to stay invested for the long term. Focus on this and you will be better off.

#6. Follow Your Plan

Lastly, you need to re-read your investment plan. Why are you investing? What are your goals? By reviewing your investment plan, you will know why you are doing what you are doing and will be able to better survive a stock market correction.

Wrapping Up

Are we due for a stock market correction? Maybe. I can’t answer that question and no one else can either. But I can guarantee you will see headlines on a regular basis talking about how a stock market correction is imminent, or that a stock market correction is coming.

Most times, these headlines are there to get you to read the story or scare you. Just remember that stock market corrections happen all of the time and every time, the market comes back after a few weeks.

As a result, your best option is to just keep investing in the stock market.

When the correction happens, focus on the long-term and keep investing. This is how you be a successful investor.

Completely agree about turning off the TV. When I first started investing (spring of 2011 right before the US credit downgrade) I listened to CNBC all the time thinking I was getting good advice. I mean someone was paying them to be on TV so they must know something, right? And then the downgrade happened, everyone freaked out and I sold everything I had at large losses because I wanted to weight the market out until it got better. And I was punished for it, as all of my holdings had gone up pretty significantly a short-time later. All because I was naive, listened to financial TV, and not focused on the long-term.

Good points throughout the article. One of my favorite things you mention is to create an “opportunity fund.” Great name by the way. Too often, dividend investors especially, have little or no cash on the sidelines. They see it as lost income opportunity from a potential dividend rather than as cash waiting for a better buying opportunity. I think it’s important to never be fully invested in anything as changes and fluctuations always present newer better opportunities. Thanks for sharing.

I thought the number one little nugget is NOT to have all your money tied up in stocks. Those that didn’t weren’t hit as hard. In other words, have your money in hard cold cash, hard investments, and bonds so if stocks correct significantly it doesn’t guarantee you’re in deep shit. Just my 2 cents. Good thought provoking article. Keep it up!

You make a good point – being diversified is the key to limiting any losses you may see when the stock market corrects.