THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES FOR MORE INFORMATION

Are you tired of jumping from investment to investment, trying to make money but always end up losing money?

Or are you a complete beginner and have no idea where or how to get started?

Today I am going to walk you through some stock market basics for success and teach you investing for beginners.

Why should you listen to what I am saying?

I was just like you.

When I first began investing, I was investing hoping to grow my money. But I ended up losing more money than I was making.

What I thought where great investments turned out to be duds.

Worse, some went bankrupt and I invested in them all the way to the end.

But then one day I changed my investing strategy.

I realized that if I keep investing the same way, I’m never going to see the results I wanted.

So I did a lot of research and reading and came up with a solid financial plan.

Since I started my investment plan, I’ve been able to grow my wealth to close to seven figures over the past 20 years.

In this post, I am going to walk you through investing for beginners and cover topics like the following:

- Why you need to start investing

- Stock market basics

- Safe investments for beginners

- Smart investments for beginners

- Stock trading for beginners

- Investing in mutual funds for beginners

- Best way to invest your money

- Best books on investing for beginners

- Frequently asked questions for investing for beginners

At any point, you can click on the links in the Table of Contents below and go right to that section. Let’s get started with investing for beginners 101!

Table of Contents

Investing For Beginners | Stock Market Basics For Success

Why You Need To Start Investing

Why do you need to start investing? If you don’t invest your money, you will have a very difficult time growing your wealth.

Let’s look at a basic example. Say you have $10,000 and you could invest it into the stock market for the next 25 years and earn an average 8% annually.

Or you could put it into a savings account and earn 1.50% annually.

What does your ending balance look like in each scenario?

By putting your money into your bank account, you end up with roughly $14,500. Not bad, you grew your wealth by $4,500.

But what is your balance if you invested that money in the stock market?

You would end up with more than 68,000! You grew your wealth by $58,000!

You might point out that with the stock market you risk losing money.

This is true.

In 2008 I lost close to 50% of my wealth.

But by 2012 I earned it all back.

And by 2017 I had more than triple what I had before the market crashed. You know what I did?

Nothing.

I never sold out of an investment. I just kept buying more shares every single month.

While losing money in the stock market is scary, you have to understand that long term, the market rises.

You will see this more when I talk about bull vs. bear markets below.

The point is, if you stick with investing long term and don’t panic and sell, you will make money.

Stock Market Basics For Long Term Success

In order to be successful long term in the stock market, you are going to have to familiarize yourself with some basic investing terms.

Knowing and understanding these terms will make you a smarter investor.

While this list doesn’t cover every investing term, it covers the basics for beginning investors.

What Are Stock Market Indexes?

A stock market index is a measurement of a section of the stock market. Each stock market index has a set number of stocks that make up the index and its value is computed based on a weighted average.

Investors use stock market indexes to get a general idea of how the market is performing.

Here are a few of the more well known stock market indexes and what makes them unique.

- Dow Jones Industrial Average: An index made up of 30 large companies

- S&P 500 Index: An index made up of the 500 largest companies in the US by market cap

- Nasdaq: A broad based market index made up of individual stocks, limited partnerships, and American depositary receipts

- Wilshire 5000: An index made up of all the publicly traded companies in the US

Each country has their own stock market indexes, these are just the major ones in the US.

What Is A Bull vs. A Bear?

A stock market bull and stock market bear are terms used to describe the general trend of the market.

A bull market is when the market is trading higher on a consistent basis and a bear market is when the market is trading lower on a consistent basis.

Note this isn’t to say the market is up every single day in a bull market. Just that the general trend of the market is up.

The same holds true for bear markets.

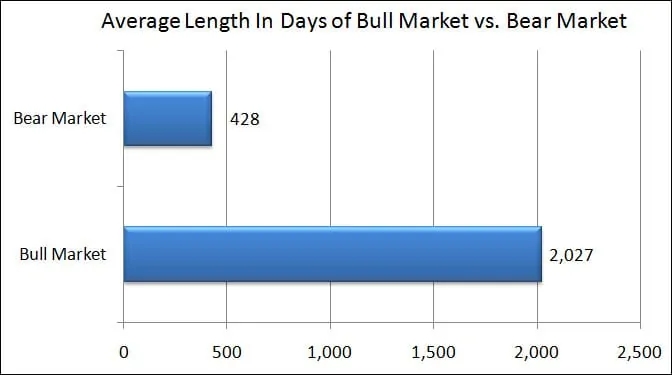

For perspective, from 1957 through 2018, there have been 9 bear markets and 9 bull markets.

But even though there have been the same number of each type of market, there are striking differences.

As you can see, bull markets greatly outlast bear markets. The average bear market lasts just over one year.

The average bull market lasts over 5 years.

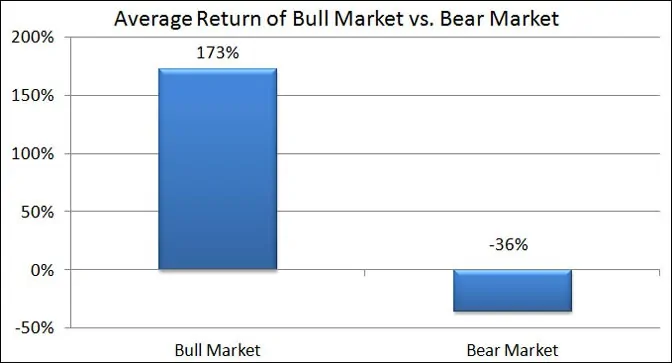

And investors earn a lot more money in a bull market than they potentially lose in a bear market.

The average bull market returns 173% while the average bear bear returns a loss of 36%.

This goes back to my point above about staying invested long term.

Yes there are times you will lose money, but if you stick with investing, you will make money.

What Is A Stock Market Recession, Correction, And Crash?

When the stock market drops, it is called different things depending on what is happening and how long it happens for. Here are the definitions of each event.

- Stock Market Recession: A stock market recession is when the economy slows down and stops growing. During this time, companies tend to lay off workers and the stock market suffers.

As a result, people are not confident in their jobs and tend to slow down in terms of spending money. This results in a cycle that repeats itself. With consumers not spending, businesses won’t expand and thus won’t hire new employees, so consumers continue to be careful spenders.

Eventually though the cycle ends, people begin spending money and the economy grows.

- Stock Market Correction: A stock market correction is when the market drops in value by 10% in a short period of time. Most corrections are temporary and only last around 4 months. Sometimes they result in a bear market, but not always.

It’s important to understand that corrections happen frequently too. They typically occur once every two years.

And while a 10% pullback sounds scary, corrections are actually a good thing. They help to keep the market in check and allow entry points for investors to get into the market.

- Stock Market Crash: A stock market crash is when the stock market as a whole has a sudden, dramatic drop in value. Usually these drops are double digit in terms of percentage drop.

In some cases, a stock market crash can be brought on by major catastrophic events, collapse of a market bubble, economic crisis, or public panic. Here is an example of each.

Stock market crash of 2008: housing bubble burst

Stock market crash of 1929: economic crisis

Stock market crash of 1987 (Black Monday): public panic

Some consider the drop of the stock market after the terrorist attacks in September 2001 to be a stock market crash as well. After the first week of trading, the market was down 14%. This crash was the result of a catastrophic event.

Now that I’ve covered stock market basics for long term success, let’s turn our attention to finding the best investments for beginners.

Safe Investments For Beginners

When it comes to save investments for beginners, you need to understand that there is no truly safe investment.

And by safe investment I mean a stock, mutual fund, or exchange traded fund that won’t lose money.

Any security you invest in when you invest in the stock market has the potential to drop in value.

But this shouldn’t scare you out of investing. Instead it gives you perspective and a better expectation when investing your money.

With that said, there are some investments that are better suited for beginning investors.

Specifically, those just getting started investing should stick to high quality, dividend paying stocks.

I recommend this because these companies will have steady growth and pay you a dividend for investing in them.

What are some good dividend paying stocks to consider? Here is a short list to get you started:

- Johnson and Johnson (JNJ)

- Pfizer (PFE)

- Exxon Mobil (XOM)

- Verizon (VZ)

- Coca Cola (KO)

- Walmart (WMT)

If you want to build your dividend stock portfolio, the best place to do so is at M1 Finance.

There you can build a customized stock portfolio and pay no fees or commissions.

They allow you to buy fractional shares, so you can get started with a lot less money than with other brokers.

This is where I have my dividend stock portfolio.

Every month, I have an automatic transfer to buy more shares and I just sit back and watch my account grow in value.

Click here to get started with M1 Finance.

Smart Investments For Beginners

While dividend stocks are safe investments for beginners, what are some smart investments for beginners?

Again, dividend paying stocks would be high on the list for the reasons I mentioned above.

But in addition to this, another option for smart investments for beginners would be low cost exchange traded funds.

These are ideal because when you buy one ETF, you are buying shares in many companies at once, giving you instant diversification.

Plus, you can build up your portfolio quickly because the share price of the ETF will be less than the multiple dividend paying stocks you buy if you built your own portfolio.

Where do you go to buy a good, low cost ETF? I love Schwab.

They have excellent in-house Schwab ETFs that have extremely low fees and you can get started with just $100.

Of course, others like Fidelity and Vanguard also offer ETFs that are good investments for beginners as well.

Stock Trading For Beginners

I’ll be honest and admit I am not a fan of stock trading for beginners.

As a new investor, there is just a lot of information out there and it can get overwhelming quickly.

Because of this, I recommend a more passive approach to investing by finding good funds to hold for a long time and continuously add money to.

But if you want to start stock trading, here are some tips for you to follow.

#1. Start with the best broker. All brokers charge commissions for stock trading.

This fee eats away at your profit, so you need to find the best broker for you at the lowest price.

Note this doesn’t mean you just go with the cheapest broker.

Your best match might be one that is more expensive but offers more bells and whistles.

#2. Avoid the popular stocks. It might be exciting to start trading Amazon or Tesla, but there is a lot of volatility in these stocks.

You are better off going with less popular companies where you can get a feeling for how the stock market works without risking losing your shirt.

#3. Set up stop-loss orders. When you buy a stock, be sure to set up a stop loss order.

This will automatically sell your holding if the stock drops below a certain point.

For example, if you set it at 5% below your purchase price, the most you could lose on the investment is 5%.

#4. Keep a journal. The reality is we forget the losses and only remember the winners.

But by keeping a journal of all your trades, you get a better idea of how you are performing and where you tend to make mistakes.

In time, reviewing your journal will help you to become a better investor.

#5. Try out paper trading. Paper trading is where you make real trades based on what the market is doing but you don’t actually put up any money.

In other words, it is like virtual reality.

You are trading in the stock market but aren’t risking any money. Of course you can’t make real money either.

But the point is to get an idea of how the stock market works before risking your money.

Investing In Mutual Funds For Beginners

Mutual funds used to be the gold standard for passive investors, but many have turned to exchange traded funds.

However there are still good reasons to invest in mutual funds.

So what should you look for when investing in mutual funds for beginners?

The first thing is to pay attention to the management fees. These can eat away at your profit. Make sure you keep these as low as possible.

Next, never pay a load. There is no reason to pay an upfront cost to invest in a mutual fund.

There are thousands of mutual funds that don’t charge you a load to invest in them and paying a load doesn’t make the investment better.

In reality it makes it harder for you to make money because a portion of your investment is going right into the broker’s pocket.

If mutual funds are your investment vehicle of choice, then stick with those offered by Vanguard and Schwab.

The Absolute Best Way To Invest Your Money

What is the absolute best way to invest your money? Based on my investing experience, the best way to invest your money is to pick low cost exchange traded funds and put more money into these holdings on a regular basis.

Why do I recommend this strategy?

Because it is what has allowed me to go from investing $25 a month to having close to 7 figures.

I tried investing in individual stocks. I had some winners.

But I had a ton of losers too. And at the end of the day, my losers lost me more money than the winners made me.

Add to this all the work I was doing researching and paying attention to the market, it wasn’t worth it to me.

Now I invest in a handful of ETFs and automatically add money to these holding every month.

Since my investing is automatic, I live my life and check in on my portfolio a few times a year.

By being hands off, my emotions stay out of investing, which is what gets most investors into trouble. This allows my money to grow over the long term.

So your goal is to set aside an amount of money each month, open an investment account and invest that amount each month, automatically.

The best option for doing this is with Betterment. In 10 minutes you’ll have an account opened and you can start investing.

They will customize an ETF portfolio just for you and handle investing, rebalance and more for you.

All you need to do is specify the monthly amount you want to invest. How easy is that?

To get started with Betterment, click here.

If you want to start investing with dividend stocks, then M1 Finance is the best place to get started.

You build your customized portfolio of dividend stocks and they invest your money for no fee.

To get started with M1 Finance, click here.

The Best Books On Investing For Beginners

While the goal of this post was to give you all the stock market basics so you could start making money right away, some of you still want more information.

I don’t want to go into more detail in this post and lose some readers, so if you want more information, here are the best books on investing for beginners.

I purposely keep this list short. This is because there are a lot of books on investing out there and you can easily spend the rest of your life reading about investing and never take any action.

Here are the top investing books that I highly encourage you to read.

This is an investing classic and a must read for any beginning investor. It walks you through the basics of investing and is applicable as you become a seasoned investor too. It even includes some recommended strategies as well. The entire time, it keeps investing simple to follow along. Overall, this is hands down the best investing book to read.

This is another investing book that has been around for a while and stands the test of time. It defines many terms you will come across as you invest and teaches you why long term investing is better and any get rich quick investment someone might try to sell you.

The Bogleheads’ are people who follow Vanguard founder John Bogle’s no-nonsense investing philosophy. In this investing book, you will find a roadmap for conservative, long term investing. It even offers an in depth guide on the various types of investments.

This investing book is from yours truly and was written with investing for beginners in mind. It covers 7 simple principals that if you follow, will lead you to success when investing in the stock market. These principals are the same ones I use to grow my wealth close to seven figures.

This investing book is opposite of the rest on the list. Instead of telling you what you should do, it tells you the 5 mistakes you need to avoid at all costs. It talks about the risks of the stock market and how investors are their own worst enemy. By avoiding these mistakes, you greatly increase your odds of success.

While this might seem like a book for corporate America and isn’t one for beginning investors, in reality this is a gem of a book for investors. Warren Buffett is arguably the greatest investor of our time and his essays are full of great lessons for investors to be successful with their money.

Frequently Asked Investing For Beginners Questions

I get a lot of questions from new investors and so I decided to create this frequently asked question section.

I’ll be updating this section as I get more questions from readers.

What stock trading site is best for beginners?

Based on simplicity and ease of use, I highly recommend Betterment for beginning investors.

It’s simple to navigate and easy to do exactly what you want to do.

In fact, you can have an account opened and funded in less than 10 minutes!

Simple and easy, just the way everyone likes it.

What is the best age to start investing?

The best age to start investing is however old you are right now.

This is because the sooner you start investing, the sooner compounding can take over and grow your wealth.

So whether you are 20, 45 or 62, right now is the best age for you to start investing.

How much money do you need to invest?

This all depends on the broker you decide to invest with. Some require you to have $3,000 just to start.

Others only require $1.

Don’t think that the ones requiring more money to get started investing are better than the others.

The minimum to start investing has nothing to do with how good a broker is.

Here are some of my favorite brokers and how much money you need to invest with them.

- Betterment: minimum investment to start: $10

- Acorns: minimum investment to start: $1

- M1 Finance: minimum investment to start: $100

- Charles Schwab: minimum investment to start: $100

What is the best investment app?

The best investment app will depend on how much money you have to invest. If money is tight and you can’t afford to invest much, then the Acorns app is the way to go.

If you can afford to invest a little money each month, say $25, then Betterment is the best investment app.

Wrapping Up

So there are all of the stock market basics for beginning investors.

While it might sound overwhelming to get started investing, know that the process of investing your money does not have to be intimidating.

You don’t need to be an expert to get started investing and grow your wealth.

You just need to understand some basics and learn as you go.

You also need to start investing right now because the sooner you begin, the sooner your money can start working for you.

If you feel overwhelmed by all of this information, here is my advice to you. Take a step back and simply open an account with Betterment or Acorns.

- Related: Click here to get started with Betterment

- Related: Click here to get started with Acorns

You can have an account opened and start investing in less than 10 minutes.

They will take care of the most important things that lead to long term success. With this taken care of, you can focus on slowly learning the rest.

You can do this and you need to start investing to grow your wealth. Don’t let another day go by without taking action.