THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES FOR MORE INFORMATION

There is a lot of information out there on how to build a good credit history.

Sadly, most of the information is all hype with very little substance.

The articles lure you in by making you think you can revolutionize your credit overnight.

The reality is that it takes work on your part to improve your credit.

But don’t make the mistake of thinking that means it cannot be done or that it will take you years and years to do.

As you will see in this post, you can improve and build a good credit history in just a few short months.

If you are willing to put forth a little effort, this post will walk you through the steps to having excellent credit.

Table of Contents

Your Ultimate Guide To Building A Good Credit History

What Makes Up Your Credit History?

To understand how to build your credit, we need to step back for a second and look at your credit score.

We need to do this because having a high credit score goes hand in hand with having a good credit history.

Therefore, by making sure we follow the steps to have a high credit score, you ensure your will have a solid credit history.

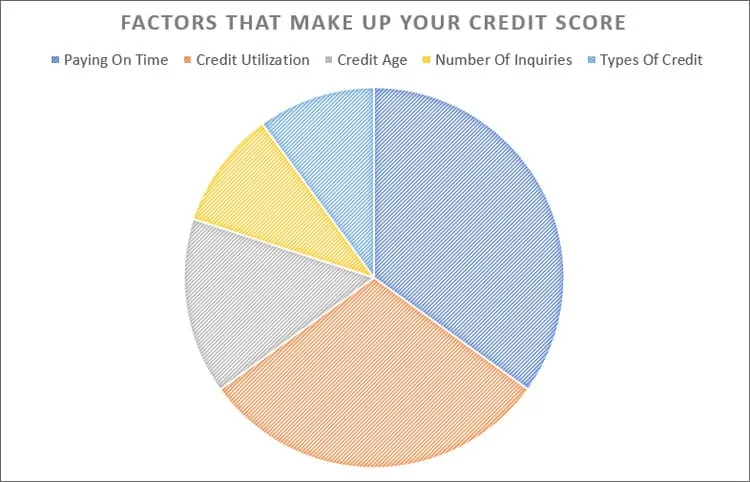

Here is how your credit score is compiled.

- 35% Paying on time: This simply means you pay your bills when they are due and don not make late payments.

- 30% Credit utilization: Your credit utilization ratio is the difference between how much debt you have versus available credit. If you have a high balance, your credit score will suffer.

- 15% Credit age: This is how “old” your credit is. The longer your credit history, the better.

- 10% Number of inquiries: This is how many inquiries there are on your credit. Whenever you apply for a loan, the creditor makes an inquiry. Note is a difference between a soft inquiry and a hard inquiry.

- 10% Types of credit. The more types of credit you have, like installment loans, revolving credit, etc., the better.

As you can see, by simply paying your bills on time, you will improve your credit score and your credit history.

And here is a tip, if you consistently make on time payments, and miss a payment due date once in a while, you don’t have to pay the fee.

Simply call up the credit card company, explain your mistake and ask them to waive any late fee.

In most cases, they will take a quick look at your payment history, see you always pay on time and waive the fee and not report the late payment.

From there, you simply want to keep credit card account open and active.

The longer you have a credit card, the more history creditors can see and thus feel more comfortable extending you credit.

For example, still have the credit card I opened in college, over 20 years ago.

This isn’t to say you should not ever close any accounts.

And credit cards you don’t use can be closed.

Just make sure you keep your oldest accounts open.

For example, when I got into credit card debt and was doing balance transfers, I opened up a few credit cards.

I ended up closing 2 of them without issue.

In the short term, my credit score was negatively affected, but it quickly came back.

My credit history shows the account was closed, but was in good standing when done so.

Just note that you only close credit card accounts.

When you pay off auto loans, student loans, or any other installment loan, it will be closed once the balance is paid back.

This will not hurt your credit.

It will help your credit showing that you successfully paid off the loan.

The Importance Of Building Your Credit

Why is it so important to build your credit?

As I mentioned, your credit history and credit score go hand in hand.

By making sure both of these are in good standing, you not only get approved for the loans you take out, but you get better interest rates.

Let’s look at an example.

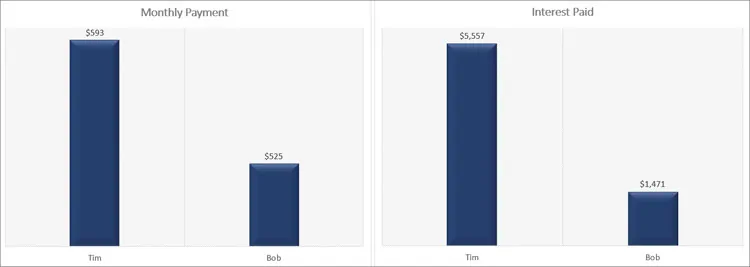

Let’s say Tim and Bob are shopping for a car.

They agree on the same car and the same price, $30,000.

The only difference is Bob has great credit and Tim has OK credit.

They both apply for a loan and both get approved.

Bob gets an interest rate of 1.9%. Tim gets an interest rate of 6.9%

Here is how this looks over the life of the 5 year loan.

As you can see, because of the higher interest rate, Tim’s monthly payment is $68 more and Tim is paying over $4,000 more in interest!

All Tim had to do to save $4,000 was to make smarter decisions when it comes to his credit.

Therefore, the more you work to build your credit, the lower interest rate you will get on your loans.

And this is critical to improving your finances over the long term.

This is because Tim is out an additional $4,000 this one time.

Chances are he will take out a couple car loans during his life and he might even take out a mortgage.

Just 2 car loans and a mortgage could easily cost him $100,000 or more in additional interest charges.

This is why it is critical you stay on top of your credit.

The Steps To Building Credit History

Before we dig into the various ways to improve your credit, we first need to make sure you have the basics covered.

By following these steps first, you lay a strong foundation so that when you do start to build your credit, you can do so without worry or issues.

Step 1: Get A Bank Account

Having a bank account is a critical step to proper personal finance.

As tempting as it is to live bank free, having a bank helps you to better manage your money and in time, helps you to build wealth as well.

Start off with a checking and savings account.

For a checking account and savings account, I prefer CIT Bank.

Their savings accounts typically pay the highest interest in the country.

You can do everything you need using their slick mobile app.

Click the link below to open your account.

Step 2: Get A Steady Job

The next step to improving your credit is to get a job.

This is important because when it comes time to open up a credit card or apply for a loan, the lender is going to want to see proof of income.

And it also helps your approval if they see a bank account, which is why you need to follow the previous step.

There is nothing additional you need to do for this step, other than to keep the job as long as possible.

The longer you are with one employer, the more stable you look to a lender and this helps you get approved for a loan.

Step 3: How To Build Credit

Now that you’ve laid the foundation, it is time to start building your credit.

You can do this one of two ways:

- Build credit with a credit card

- Build credit without a credit card

Let’s look at both of these options in detail.

How to Build Credit With A Credit Card

Building credit with a credit card is not a difficult process.

In fact, you should be able to do this without much issue at all.

The first step is to find a credit card and apply for it.

But don’t pick just any credit card.

Look for credit cards that are designed for those with little credit or bad credit.

Here is a link to some of the best credit cards for this situation.

At this point, you don’t need to worry about the interest rate. Why?

Because you are making all of your payments on time and as a result will never pay any interest.

Just focus on applying for a card that is designed for you and ignore the interest rate.

Once you get approved and get your card, here is how you will build your credit.

#1. Make one or two small purchases a month. Decide on something every month to buy using credit. For example, charge your Netflix account and nothing else.

#2. When the bill comes, you pay it off that day. Log into your online bank account and set up the bill pay feature. Or, log into your credit card account and pay online there.

#3. Rinse and repeat.

Here is why this works.

When you make one purchase on your card every month, you eliminate the risk of overspending.

This is what I did when I opened my first credit card.

I am going to date myself, but I would buy 1 CD every month, charging $10-$15 to my credit card.

Then I would pay the bill in full every month.

This allowed me to begin to establish good credit.

If for some reason you cannot find a credit card that will approve you because you have bad credit or some other issue, there is hope.

Here are 2 additional options for you.

Get A Secured Credit Card

If you have bad credit or for some reason cannot get a regular credit card, getting a secured credit card is a great option.

The difference with a secured card vs. an unsecured credit card is that after getting approved, you have to send in a deposit as collateral in the event you default on making payments.

For example, let’s say you open a secured credit card that requires a $500 deposit.

You send in the $500 and get the credit card.

You use the card like a traditional credit card, using it to purchase things and then getting a monthly statement.

Your deposit is not used to pay off the balance on the card.

You have to make the payments and if you don’t pay the entire balance, you are charged interest.

If you close the account, your deposit is refunded to you.

The amount of deposit varies but ranges from $200 up to $1,000.

If you go this route, simply follow the same advice as above and only charge one thing a month and pay the balance off in full every month.

Become An Authorized User

Another option is to be added to someone else’s credit card as an authorized user.

This is common practice between spouses.

One spouse has a credit card and adds their significant other as an authorized user.

The authorized user gets their own card and as payments are made each month, both credit histories improve.

This is a great option for children turning 18 as parents can keep a close on their spending and help them to avoid digging themselves into credit card debt.

How To Build Credit Without A Credit Card

What if you want to build your credit without a credit card? What are your options?

Luckily, credit cards are not the only option you have.

If you are going to college, you can take out student loans.

Of course, you don’t want to take out more debt than you can afford to pay back.

But this is a great way to build your credit history.

You will be making monthly payments for many years, and this will help with your credit.

Another option is to take out another type of loan, like a car loan.

The same idea with student loans applies here too.

By making monthly payments, you will steadily improve your credit.

Again though, just don’t take out a loan for the sake of building credit.

Additional Ways To Improve Your Credit

There are a few other things you can do to help improve your credit.

These things won’t have an impact in increasing your credit score, but they will help you avoid identity theft and the potential of ruining your credit.

Check Your Credit Report For Errors

The information in your credit report is entered manually, which means it is easy to make a mistake when typing in your address or the information about a credit account.

Because of this, it is important that you review your credit report annually so can correct any errors quickly.

To get a free copy of your credit report, visit AnnualCreditReport.com.

This sites allows you to download 1 free credit report from each credit monitoring agency per year.

But here is a trick to get your more frequently.

Don’t get your credit report from all 3 major credit bureaus at the same time.

Instead, get one report every 4 months.

For example, here is a schedule you could follow.

- January: TransUnion

- May: Experian

- September: Equifax

Then repeat the process every year.

This allows you to constantly stay on top of your credit report and fix any mistakes right away and spot any potential fraud.

Understand Where Your Credit Stands

By knowing what your credit profile looks like, you can make smarter decisions to improve your credit.

For example, if you have a credit card and are in the market for a car, you might consider taking out an auto loan versus paying in cash to help you build your credit.

By knowing where you stand and making strategic credit decisions, you can improve your credit without much effort.

Frequently Asked Questions

If you are short on time, I created this FAQ section so you can quickly understand how to build your credit history.

How long does it take to build credit history?

You don’t need to wait years to build your credit.

In as little as 3-6 months of having a loan or credit card and making timely payments, you will begin to build your credit.

Just remember to be patient with it and not try to build your credit up too quickly.

This is a classic mistake many people make and it ends up with them being buried in a mountain of debt.

How can I start building credit at 18?

At 18, the best and easiest way to start building credit is to become an authorized user on one of your parent’s or another family member credit cards.

This is preferred since you likely won’t have a job, especially of you are going to college.

By being an authorized user on your parents credit card, you can get the benefit of their credit history will at the same time building yours.

How can I build credit in my 20s?

When you are in your 20s, it is still an option to become an authorized user on your parent’s credit card.

However, by now you should be working a job and therefore, you can apply for credit without their help.

Simply open a credit card account and follow the tips I outlined above by making one purchase a month and paying the balance off in full.

In just a couple months, you will see a positive impact on your credit.

Should I look into a credit builder loan?

Credit-builder loans are an option when you are first starting out and looking to establish your credit.

The only negative of this type of loan is that you need to have the money to deposit as collateral in the first place.

As a result, I like the idea of getting a credit card and making one purchase a month and paying it off to build your credit history.

How can I build perfect credit?

There is no magic when trying to have perfect credit.

The best way to achieve this is to be patient and have discipline.

For starters, keep your credit card balances low by paying in full.

To make this easier, set up automatic payments with your credit card company.

From there, take out loan products as necessary.

Don’t just take out a lot of loans to try to build your credit.

Be a responsible borrower and borrow when you need it.

Then pay off the balance as required.

If you do this, in a few short years you will have close to perfect credit.

Why are the interest rates I pay high when I don’t have credit history?

Lenders see you as a higher risk when you don’t have enough credit history.

Because of the higher perceived risk, they charge you a higher interest rate.

This shouldn’t be an issue with credit cards, since you are paying the balance in full each month.

But it can be an issue if you take out an auto loan.

To save yourself the most money here, make it a point to pay off the loan early.

In time, having a strong credit history will result in getting lower interest rates.

Wrapping Up

At the end of the day, building a good credit history is not a difficult task.

What makes it tricky is the information out there that leads you astray thinking you can quickly improve your credit overnight.

You can’t.

But you can improve your credit history in a short 3 months by following the tips outlined in this post.

If you are patient and follow along, there is no reason why you won’t see improved credit in as little as 3 months.

Great tips. May I ask off-topic question?

Why don’t you use h3 tags in your list of steps. Usually H-tags are bigger and make your text more readable ’cause it divides the article into blocks. Just try to do the experiment and compare 2 variants.

Thanks for your time.

Personally, I hadn’t thought that much about H-tags. Maybe I will try it if I have the time to get around to experimenting that way.

Good article, very informative. I liked the part about riding on someone elses credit. Not everyone knows about it nor how quickly it works.