THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES FOR MORE INFORMATION

Are you in debt? If you are like the typical American, then you are in debt. Do you want to know how to beat debt? Are you tired of worrying how you are going to pay your bills when they come in the mail? Or worse, are you losing sleep over your debt? Do you want to overcome your debt once and for all?

I was in your shoes a few years ago. I was once in credit card debt to the tune of roughly $10,000. I wasn’t happy, my work, health, and relationships suffered, and dreaded getting the mail.

But I was able to beat debt. How did I do it? With hard work, reflecting on how I got in debt, patience, and a lot of failed attempts along the way.

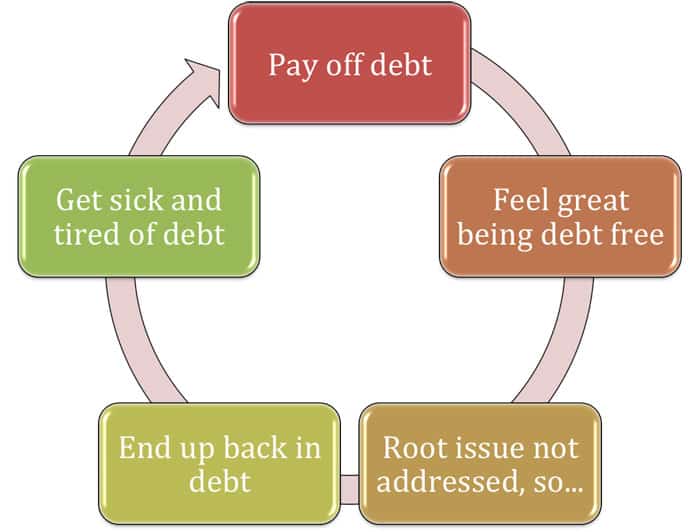

Trapped In The Endless Debt Cycle

If you have tried to get out of debt only to find yourself right back where you started, I can sympathize with you. I had a large balance on one credit card when I decided I was going to pay it off and get out of debt. Here was my original plan for how to beat debt:

- Open up a second credit card, one with a 0% balance transfer offer and move my debt over to this card. I would make my payments on the new card while saving money on interest charges.

How well did that work out for me? It was a complete failure. While I did transfer my balance, I simply started to spend on the original card once again. After a few months, I put my foot down and said enough is enough. I was going to beat debt this time.

So I opened up a third credit card. I transferred my balance on my first card to the new card to again, to save on interest. Then I began to make payments to pay off my debt. Sadly, I went right back to spending on that first card again.

As you can see, I was trapped in the endless debt cycle that you may be in.

Unfortunately, you are going to be stuck in the cycle until you dig deep down inside and get real with yourself. That is the only way to beat debt. And this is what led me to getting out of debt once and for all.

Table of Contents

How To Beat Debt

For me, it happened one day when I was out shopping for a new jacket. I didn’t need a new jacket. I already had 3 of them. As I was considering buying this jacket, the light bulb went off and I realized what I was doing. I was buying things to make me feel better.

At the time, I was depressed. I had just graduated college and couldn’t find a job. I thought when I graduated I would find a job paying six-figures and I would be on the fast track to millions. But it didn’t work out that way.

I became depressed and started to buy things like clothes and electronics to make me feel better, to get me high.

Sadly, the high I got from buying things wore off faster each time, causing me to get into more debt at a rapid pace. Fortunately, I had my wake-up call at the store that day.

I put the jacket back and I went home. On the drive home, I admitted to myself that I was unhappy and hated life.

When I arrived home, I piled up all of the clothes I recently bought on my bed. I took a picture. Then I took a picture of the electronics too. I carried those pictures in my wallet to remind me that these things aren’t going to bring me happiness. I need to be happy with who I am.

It wasn’t easy, but over time and with some professional help, my depression subsided and I was able to be happy with what I had. I no longer had to go find happiness, I found it within.

Look Inside For How To Beat Debt

If you are struggling with debt, I encourage you to look inside yourself. In most cases, your spending problem isn’t the root cause of your debt. It’s something else. Until you get at that root, you are going to continue the debt cycle.

It’s like a weed in your garden. You can pull it out, but unless you get the root, that weed is coming right back in a few weeks.

Realize that digging deep within won’t be easy or fun. Many times it will be painful. But it is what needs to be done if you ever want to beat debt. To help you get out of debt and stay in a more positive mindset, don’t focus on the current pain.

Instead, envision your life in the future. Here are the questions to ask yourself. I encourage you to sit down and write down the answers to these questions. This will allow you to revisit them if you are struggling.

- What will it be like to live debt free? Will you no longer be afraid to get the mail?

- How will it feel to sleep at night without the stress or worry of debt?

- How will your relationships improve?

I bet that if you close your eyes right now and silently say to yourself I am debt free 5-10 times, you will get a smile on your face and chills up your spine. Doesn’t it feel good to think about beating debt?

Overcoming The Day To Day Stress Of Being In Debt

Now that you have decided to pay off your debt, you need a plan to handle the stress that debt has on your everyday life. Here are some simple tips to keep your stress level in check.

- Be mindful. Focus on doing one thing at a time with your full attention. This takes practice, but learn to live in the moment and give it your full attention.

- Learn a relaxation exercise. Learning to relax for a specified period of time will help you learn to relax during the day and reduce stress. Simply doing some breathing exercises can work wonders on your stress levels.

- Do not resist the stress. When you get upset at being stressed, it only stresses you out more. So when you feel stressed, admit it and work to calm yourself down as opposed to getting frustrated that you are stressed.

- Learn patience. This is important because the emotion most strongly associated with heart disease is anger and hostility. When I become impatient, I start counting in my head and do some deep breathing. This helps me to be more patient.

- Decrease the frustration of failure. Instead of thinking you are worthless when things go wrong and you don’t pay off your debt on your first try, realize progress comes from learning from our mistakes. Ask yourself what went wrong and try again.

- Keep things in perspective. Don’t make the mistake of creating doomsday scenarios in your mind. Most times these never play out in real life. Get comfortable with knowing you won’t be in debt forever, but it will take time to beat debt.

- Take care of yourself. Eat nutritiously and mindfully, enjoying the taste and aroma of your food. Get regular exercise. Doing these things will help to keep stress levels low and will also help you get a more restful night’s sleep.

- Talk with someone. If you’re overwhelmed by stress and basic techniques are not helping, talk to your friends and family. Doing this can bring on new perspectives and help you relieve stress and stick to paying off your debt.

Your Plan To Beat Debt

Now that you looked inside and got to the root of your overspending, it is time to make a plan to get out of debt once and for all.

If you search online for how to get out of debt, you are going to find numerous methods. I’m going to tell you the one that worked best for me because I think it will work great for you as well.

- Related: Find out what debt to pay off first

Here are the steps to help you get out of debt once and for all.

Step #1. Look At Your Income And Expenses

Look at your income and expenses and see what you spend your money on. Ideally you will do this step for one month.

Write down every penny spent and then compare that to how much you have left in your bank account. Chances are when you do this, the two won’t balance out. You will have forgotten to record an expense here or there.

This is OK. Just add a line for the difference and call it “WTHK”, which is short for “Who The Hell Knows”. The goal here is to make sure this amount doesn’t amount to anything substantial.

For most people, try keeping your WTHK under $20.

During this first step, your objective is to make sure that you know where your money is going. This will allow you to easily make adjustments so you can pay off your debt faster than you otherwise thought.

Step #2. Understand Your Values

Teach yourself to look at your budget as the story of your life. Where are you spending your money? Do the things you spend money on add value to your life? Chances are they don’t.

For example, I was spending money on having all the cable channels possible. But this didn’t add to value to my life. In fact, I rarely watched most of the channels.

What I did value was spending time with my friends. So I canceled my expensive cable package and focused more on spending time and money with my friends.

During this step, your objective is to figure out what you value in life and compare that with how you are spending your money. If you aren’t spending money on things that add value to your life, you can easily cut back on this wasteful spending without much of the pain.

Step #3. Review Your Cash Flow

Your cash flow is fancy way of saying how much money you have left at the end of the month. If your income exceeds your expenses, then you have some money to throw at your debt and start working on paying it off.

But if you are spending more than you earn, then you need to do some work. And to be honest, even if you aren’t spending more than you earn, this step is still important as it can help you to cut back on some areas so you can put more money towards paying off debt.

Many people will tell you to cut out the little things to improve your cash flow. I disagree. Cutting $3 by not buying a coffee isn’t going to cut it for a couple of reasons.

First, you will resent the fact you can’t have your favorite morning coffee. Second, if you have a lot of debt, you can’t just cut out the $3 coffee habit. You have to cut a lot more out of your spending. This will lead to even more resentment.

And finally, you have to do these things over and over again, every day to see a meaningful impact.

Eventually, you will get tired and start spending again and then get frustrated you aren’t making progress in paying off debt.

Instead, you need to focus on the biggest expenses you have. When you do this, you save a lot of money and you only need to do it once. The savings will happen automatically every month.

So what are the best big expenses for you to slash? Here are my favorites.

Refinance your mortgage. This is hands down most people’s largest expense. And with interest rates still low, you can save thousands each month by refinancing. Just play around with this calculator to see how much you could save every month.

By refinancing, you spend a few hours to reduce your monthly bill and save money every month after that.

Get creative with your housing. Maybe refinancing doesn’t make sense for you. Can you move? Owning a smaller house will save you money every month. If that isn’t an option, can you rent out a room to earn some additional money?

If you rent, can you rent somewhere that doesn’t cost as much? Maybe bring in a roommate to cut down on your bills?

While living with others might not sound ideal, it isn’t forever. It’s just for a short period of time so you can pay off your debt.

Appeal your property tax. This is simple to do, yet so many people overlook it. If you are paying a higher property tax than others in your neighborhood, you can appeal it.

To appeal, contact a local real estate attorney. They will do the research to see how much you can potentially save. If the savings is substantial, the attorney will appeal for you and present your case in court. You do not have to be present.

If your appeal is granted, you save money every month. We did this and saved over $1,200 a year. The attorney only charged us if they were able to get a reduction in the tax and their fee was a small percent of the savings.

The result is a lower monthly mortgage bill since we escrow our taxes.

Shop for less expensive insurance coverage. Insurance costs seem to rise every year, regardless if you file a claim. And if you don’t shop around for coverage, you could easily be paying more than you should.

In fact, insurance companies have gotten into hot water for just increasing premiums for no reason. As a result, you could be paying a lot more than you need to for insurance coverage.

So take 15 minutes and get a free auto insurance quote. Then take another 15 minutes and get a free home insurance quote. You may be surprised with how much money you could save.

When we looked into this last year, we saved over $300 combined for simply finding better options. And all it took was a half hour of my time.

Use Trim to save on your cable bill. Another area where you are paying a lot of money is on cable television. Here again, it seems prices only go up.

Negotiating with the cable company has to be one the worst things to do, and because of this, many people avoid it. But you can still save money on cable.

Just open up an account with Trim. They will look over your cable bill and other recurring bills, and work to find deals for you. They tout a 70% success rate and only take a small cut of your savings.

In other words, you have nothing to lose. To try Trim yourself, click here.

Check your house for energy savings. The final large expense many people face is electric bills. As with the other expenses I listed, you have some options here too.

Here are a few things we to do keep our electric bill in check.

- Check for drafts around windows and doors. This works best in the winter as you can literally feel the cold air. Then take some caulk and seal the gaps.

- Buy a programmable thermostat. There is no reason to run the heat or air conditioner all day when you aren’t home. By using a programmable thermostat you can save a serious amount of money. Here is the one we bought on Amazon.

- Use smart power strips. Many electronics sap power even when turned off. This is the dreaded standby mode. Luckily there is an easy solution to this. Buy a smart power strip. You plug one device into the main outlet and when that device is turned on, all the other devices will turn on as well. It works best for televisions and related equipment. This is the top rated one on Amazon.

- Buy ceiling fans. We installed ceiling fans in our bedrooms and can now keep the air conditioner temperature setting higher all summer long. Thanks to the air moving across our bodies, it makes it feel colder than it really is.

- Install LED light bulbs. By switching over to LED bulbs you use a fraction of the electric for the same brightness and they last many years longer. Unfortunately the price to replace all of your bulbs can be expensive. The solution is to only replace the main lights you use, like kitchen, bathroom, bedroom, etc. and then slowly replace the rest. Also keep an eye out for sales too.

There are some simple things you can do to cut down on the large expenses in your life. We appealed our property tax, shopped around for insurance coverage, negotiated our cable bill, and used some of the tips for reducing our electric bill.

The result was an annual savings of close to $2,500. How nice would it be to throw an extra $2,500 towards your debt?

During this step, your goal is to slash as many large expenses as possible. Doing just a few minutes of work and save you money throughout the year. Then you can put this money towards your debt.

Step #4. Look At Your Income

As great as it is to slash some of your expenses, we can’t overlook your income. By increasing the amount of money you earn, you can really make a dent in your debt.

You want to find some things that can make you money consistently over time. Selling stuff on eBay and doing garage sales helps bring in money, but it is temporary, unpredictable and unsustainable.

To kick your debt’s ass you need to develop reliable, regular and sustainable sources of income.

You need to come up with some ideas for how to start making more money. To do this, take some time and figure out what you enjoy doing and seeing if there are ways you can turn it into a source of income.

Additionally, see if there are things that are so simple, they won’t feel like work at all. Here are a few ideas to help get you thinking.

Uber: Want to make extra money on your schedule? Sign up to drive with Uber! You use your own car to give people rides around town. And it’s super flexible. Just hop in your car, turn on the app, and you can receive pickup requests from riders in your area.

You could even do this on your drive to and from work each day.

To start the application process, click here.

Uber Eats: Maybe driving others around isn’t your cup of tea. Try delivering food with Uber Eats. You’ll bring the local food people love right to their door. You can deliver day or night when it is convenient for you.

If approved, you just turn on the app, and you can start receiving delivery requests in your area.

To start the application process, click here.

Swagbucks: You can do a lot of things on Swagbucks, but online shopping is my favorite. When you shop through Swagbucks at your favorite online stores, you earn Swagbucks which you can turn into cash.

For example, if a store is offering 4 points per dollar spent and you spend $100, you earned 400 points. This is equivalent to $4. When you have 2,500 points ($25), you can request payment via PayPal.

Use it and start earning cash back for the things you are already buying! New users get $5 just for signing up. Click here to get started.

QKids: Teaching English to Chinese students virtually is what QKids is all about. And you can earn up to $20 an hour doing so. Most lessons last 30 minutes and you teach first thing in the morning or late at night.

It’s a great way to earn money on a regular basis.

To get started with QKids, click here.

During this step, you want to find some ways that will bring in more income on a regular basis for you. Note that you can still declutter your house and make some fast cash for one time debt payment. But most of your effort should go towards more reliable income streams.

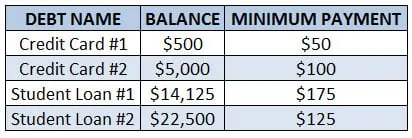

Step #5: Organize Your Debt

To beat debt once and for all, we are going to use the snowball method. With the snowball method, you pay off your smallest balance debt first, then the next smallest, and so on.

The idea here is momentum. Picture a snowball rolling down a giant hill. As it rolls, it gets bigger and rolls faster. The same thing is going to happen to the money you put towards your debt.

As you go along, you will put more money towards your debt and will quickly pay off your debts.

To get started, create a list of all of your debts and list them with the smallest balance first, and follow that in order to the largest. You also want to note the minimum payment for each one too. Here is what this looks like:

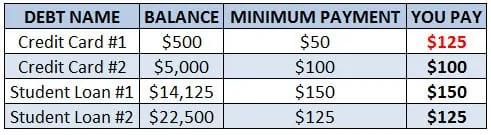

Step #6: How Much Can You Pay Per Month

Once you have your debt organized, you will look at how much money you can put towards your debt each month. Take into account any extra money from reducing expenses and earning more income.

Let’s say after completing this step, you can comfortably pay $500 a month on your debt. You will divide this amount up among your debt in the next step.

Step #7: Start Paying Off Your Debt

Now you are going to start paying off your debt. Make the minimum payment on all of your debts except for the smallest balance, the first one on your list.

Whatever amount is left over from the $500, you put this amount towards the smallest debt. Here is how this looks.

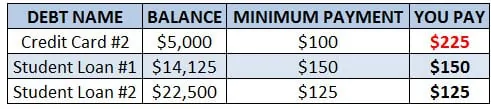

You will continue to do this every month until the smallest debt is paid off. When the smallest debt is gone, you will begin to work on the next smallest debt. Do the same thing by paying the minimum on every debt except for the second debt, which is now the one with the smallest balance.

For this debt, you are going to put the amount that is left over from the $500. Here is what this looks like.

Here is the beauty of the snowball method. You will pay off this second debt faster because you are paying the minimum that you were paying, plus all the money that was going towards your smallest debt.

And as you pay off more debt, more and more money goes towards the smallest debts, helping you to beat debt fast.

Step #8: Keeping Things In Perspective

Now, even though the plan sounds simple, it will still take time. You aren’t getting out of debt overnight. Depending on how much debt you have and how much money you can throw at your debt each month will greatly determine when you are officially debt free.

Don’t lose focus or get frustrated if it is taking longer than you hoped. Don’t give in to late night commercials promising you will be debt free tomorrow.

To truly beat debt takes time. The best thing I did to keep me motivated was to involve a friend. I would update him on the payments I was making and when I paid off a debt.

His encouragement and excitement helped to push me along during the entire process. I encourage you to find a close friend as your pay off debt partner.

Wrapping Up

I urge you to look within to beat debt. It’s the only way you will break the cycle. You have to get at the root cause of why you are overspending. Once you find the root cause and address it, you can begin to pay off your debt once and for all.

When it comes to taking that step to pay off your debt, make the process as easy as can be so that you set yourself up for success. I highly encourage you to use the snowball method I outlined. It will help to keep you motivated and to push through until you are debt free.

You can beat debt. With a little effort, you will experience the joys of living a debt free life.

[Photo Credit: RyanMcGuire]

Interesting comparison! I find I have to keep a close eye on myself as well but regarding food about celebrations and/or emotions. Generally, when I get good news about something the first thing I want to do is celebrate with food. I don’t have a problem with my weight but I could see it becoming an issue if I don’t curb my behavior. Sometimes it’s the little things that are preventing me from really buckling down and excelling at my financial goals.

I think a lot of people have a tough time with the little things too.

I have to agree that spending is not usually the problem. Once I figured out why I spent money, paying off debt and getting back in control was much easier than before.

I think others will find that this is true too. Thanks for sharing Michelle.

Funny, paying off the debt isn’t the hard part…staying debt free after that is often more of a challenge. You’re right about finding the root of the problem and I like the idea of a visual aid to keep you on target!

Great read! I’ll definitely be checking out these tools!!