THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES FOR MORE INFORMATION

It doesn’t matter where you live, groceries will always take up a major chunk of your income.

In fact, Americans spend about 33% of their household income on groceries per month, according to a report by the USDA.

Another report published by GoBankingRates found that men tend to spend less on groceries than women, $290 per month versus $323 per month.

This is a huge expense which you can reduce with the help of proper planning.

If you’re like most families, you are having long discussions on how to spend less on groceries.

It’s obviously easier said than done.

We’ve all been there and most of us have failed, which is why you’re here.

I won’t lie. It wasn’t easy for me either.

But now that I have been going grocery shopping for years, I know how to grocery shop on a budget by using my own grocery shopping strategies.

In this article, I’ll talk about how to lower your grocery bill and save money.

By the end of this article, you’ll be able to start using these grocery shopping strategies to save thousands a year on your food bill.

Table of Contents

How To Spend Less On Groceries

Know Your Grocery Expenses

It is important to know how much you’re spending on groceries so you can develop a plan to go food shopping on a budget.

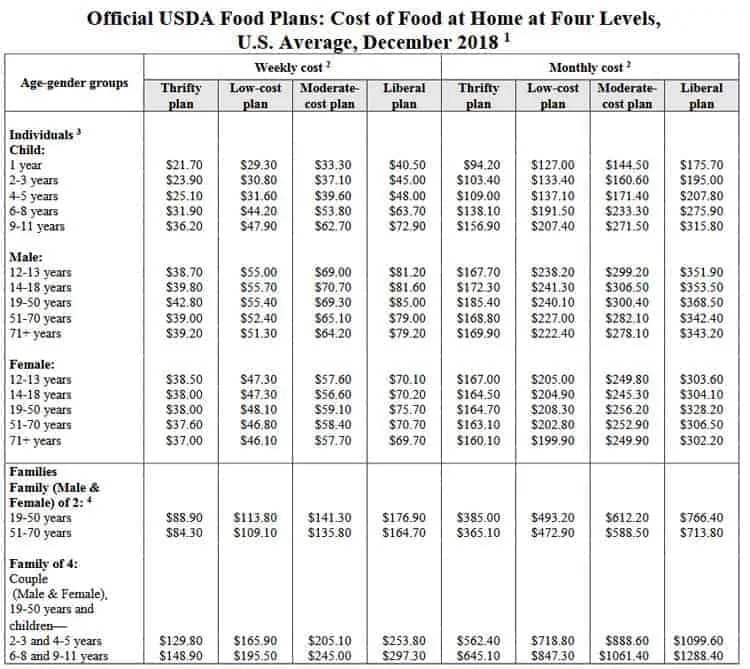

A good first option is to have a look at the USDA Food Cost reports.

The report contains information on what food should cost families.

It is divided into four different plans:

- Liberal

- Moderate cost

- Low cost

- Thrifty

The report can help you understand how to spend less money on food and give you a rough idea as to how much.

For example, you can see that for an adult male, age 19-50 years, the average monthly food cost is $185.40 a month on the thrifty plan.

It can even help you to learn how to be a smarter shopper.

Your first step is to calculate your grocery expenses so you know your expected grocery savings.

It is quite easy to do. Just keep an eye on all your receipts.

By definition, groceries include all kinds of food items including fruits, vegetables, meats, bread, etc.

When we talk about knowing your grocery expenses, you need to answer questions such as:

- How much do I pay for groceries?

- Which items do I spend the most on?

- Which items do I spend the least on?

Having answers to these questions will help you a great deal.

You can use a grocery calculator, based on the U.S. Department of Agriculture’s Low-Cost Food Plan, to help you understand where you are overspending compared to average.

Create A Grocery Budget

The next step is to create a budget.

I once again suggest that you stick to the USDA Food Cost reports and try to move from one plan to another.

For example, if you’re on the low cost plan right now, you can move to thrifty or frugal shopping.

The idea is to save as much as you can and wherever you can.

Understand that your overall grocery budget will depend on your lifestyle, tastes, location, and the number of family members in your household.

Moreover, family member ages also make a difference.

For example, homes with infants will have different requirements when compared to homes with teenagers.

The most important thing is to understand how much you are currently spending each month on groceries and developing a lower goal amount.

The lower goal amount can be anything you want, but I suggest that you stick to a figure closer to your current spending.

By reducing your grocery budget slowly, it will lead to more success long term.

I also suggest that you have a weekly budget instead of a monthly budget.

It will help you plan easily and give you a chance to correct mistakes.

If doing all the work manually sounds too much then you can try apps like EveryDollar (free or $99 per year for bank syncing) or YNAB (free 34-day trial then $50 per year).

They’ll make the job of grocery budgeting easier.

Once you’ve decided how much to spend, it’s time to know where to spend.

This includes creating a weekly meal plan and then making a grocery list.

How To Make A Meal Plan

Let’s talk about how to make an affordable meal plan as meal planning is one of the most important parts to save money on groceries.

Note that I am not talking about planning for special diets either.

Meal planning is a strategy that every person should be using to cut their grocery bill.

The process of creating a plan is simple.

#1. Write down the foods you like to eat.

#2. Gather up the grocery store fliers you get in the mail.

#3. Search through these fliers looking for what is on sale that you eat, and begin to make meals out of them.

For example, if chicken breasts are on promotion this week, you can purchase a couple of pounds so you have dinner once or twice this week.

Then if frozen vegetables are on sale, you can buy a few bags to compliment the chicken you are cooking.

Repeat this process until you have a full weeks worth of meals planned.

Just understand that you won’t be shopping at just one grocery store.

Most times you will have to visit a couple different ones to get the sale price.

In order to know you are getting a good price, you need to do a little work.

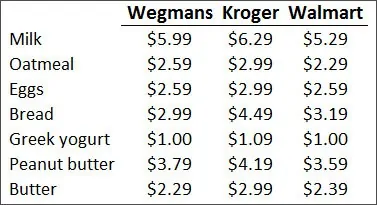

I suggest you create a spreadsheet and list the items you frequently buy in the first column and then the various stores in each of the next columns.

Then simply fill in the regular price of the item at each store.

For example, if you look at the image above, you will see that for butter, the cheapest regular price in my area is at Wegman’s.

When I see a sale on butter, I know it is a good price if it is lower than $2.29.

Once you have this information, you can start to effectively create a money saving meal plan.

The next steps for smart planning are simple to follow, you just have to keep them in mind to help you save the most money.

Here are some of the key meal planning ideas to keep in mind:

- Only choose items that you really need. No need to stock items as many grocery items are perishable and may end up causing you to lose money. Also, deals rotate, so you will be able to buy again at a discount in the future.

- But you can stock up for amazing deals. If the sale is great, and you are buying shelf stable foods, then stocking up can be a huge savings. There are a few times a year when one store near me offers great deals on most of the items I get. I regularly use this promotion to buy in bulk. Many times I spend $30 on items that would normally cost me $70.

- Keep an updated price list. It is important to know what the regular prices are. This will help you to know what is a good deal. Over time, prices rise, so make sure you keep your list current.

- Make a weekly plan. As you follow this plan, keep an eye for improvement and implement those in the next week’s plan. For example, maybe you discovered a new dish you can add into your rotation of meals.

- Play around with the plan. You don’t have to have the same plan for every week.

- Don’t think you need meat. Meat tends to be the most expensive items on your list. One way we save a great deal is to have meatless Mondays every week. This means eating pasta, soup, or having breakfast for dinner. Both eggs and pasta are inexpensive and can stretch your dollars farther.

- Cook at home. There are many meals you can make at home in very little time. In other words, don’t spend the money on ready-to-eat meals at the grocery store. Many of these are loaded with massive amounts of salt and on a cost per serving basis, are a rip off. If you are stretched for time, consider cooking using a crock pot or an instant pot. Both make cooking fast and simple.

- Make extra. When making dinner, make a little extra so that you have leftovers. This will save you money by eating the same meal the next day for lunch or even for dinner again later in the week.

Taking the last point one step further, my wife and I make it a point to plan a few hours on the weekend cooking meals.

The benefits of this are enormous.

First, by cooking on the weekend, we don’t have to worry about what to make for dinner during the week.

All we have to do is heat up the food we already made.

This is huge because we all know how we get stuck at the office, or one of the kids has an event, etc. and we resort to eating fast food and wasting money.

The second benefit is lunches.

We rarely go out to eat for lunch at work because we have so much food ready at home. We just pack up some of it, take it to work and reheat it.

You can create a compelling meal plan by following these simple tips.

I suggest that you listen to other family members as well so everyone can enjoy their favorite meal.

Know Where To Shop

Now that your meal plan is ready, it is time to know where to shop.

Above I mentioned that you will be shopping at various grocery stores.

By shopping at various stores, you will reduce your grocery bill.

Here are some tips to save money by knowing where to shop.

- Try online shopping. Online shopping can help you save a lot of money. Almost everything can be bought online now, from fruits to vegetables to dairy products. You only need to choose the right online shopping store. Pick one that offers free shipping, fresh products, and low rates so that you have no issues. This is one of the best ways to perform grocery shopping on a tight budget.

- Choose different stores. Do not make the mistake of going to one store only. You may get in the habit of going to one store because it’s nearby, but this is a mistake since another store may have the same products at a cheaper price. It’s always a good idea to shop around a bit.

- The farmers market may be helpful. Call it frugal shopping, but the farmer’s market can be the place to grocery shop. You don’t only get fresh vegetables and fruit under one roof, but you also get it at a lower price since you cut out the middleman.

- Shop discount stores. Discount grocery stores, like Aldi and Lidl, offer great products for a much lower price. And don’t overlook Walmart. They have an excellent selection of organic foods at a fraction of the price.

Know When To Shop

To save the most money, you need to know when to shop.

A study performed by the grocery app Ibotta shows that the weekend can be an expensive time to shop for groceries.

The reason is simple.

The store is crowded, so people tend to make bad choices just to get out of the commotion quickly.

On top of this, since most people grocery shop on the weekends, stores have free samples for you to try.

This gets you to buy things that aren’t on your list and you end up spending a lot more money than you planned.

Because of this, shopping during the week is a better option to save but your total savings will largely vary depending on where and what you buy.

For example, wine is about 4% cheaper on Tuesdays than the rest of the week.

Similarly, bread is about 2% cheaper on Wednesdays and beer will help you save 1% if you get it on Wednesdays.

Wednesday can be a good day to purchase produce as well. You can save about 3%.

But the right day changes from product to product. Ice cream, for example, is the cheapest on Fridays.

Finally, buying in season makes a big difference too when buying fruits and vegetables.

For example, during the summer months, strawberries and blueberries are always discounted.

But during the winter, they are always full price.

Because of this, it may make sense to buy extra during the summer and freeze them so you have your favorite fruit during the winter.

Finally, if you plan to visit the farmers market, the best time to do so at the end of the day, right before closing.

Many times they want to get rid of the food they didn’t sell and will be more willing to offer big discounts.

By making it a point to shop at the right time, you will save as much money as possible.

Pay Attention To The Unit Price

Most shoppers focus on the retail price of what they are buying and not the unit price.

The retail price is misleading because you are comparing apples to oranges.

Here is what I mean by this.

You see 2 boxes of cereal, one for $3.49 and the other is $4.49.

You buy the lower priced one to save money.

But did you really save money?

If the box you bought is a smaller size, you ended up paying more money!

This is why you need to look at unit prices.

It levels the playing field so you can see exactly which item is the cheapest and is the easiest way to save money on groceries.

Most times you will find that the larger the item, the better the price.

Yes, the price you pay will be higher, but you will get more servings at a lower overall price.

The only word of caution here is that it doesn’t always make sense to buy a larger item to save money.

If you truly only need a small amount, then buy the smaller size item.

What Not To Buy At The Grocery Store

Your plan for saving money at the grocery store is coming together.

But there is one other area of concern.

Grocery stores sell a lot of products. Some deals are good, others are bad.

The best tips for saving money on groceries include the things you should never buy at the supermarket.

Here is the short list you need to remember.

#1. Precut Produce

When time is short, it can be tempting to buy that container of precut pineapple or the sliced carrots.

But doing so is literally throwing money out the window.

Supermarkets charge a premium for precut produce.

For example, a small container of sliced pineapple will cost you over $4. A whole pineapple will cost you $1.99.

You would need about 4 of the containers to equal the amount of fruit from one pineapple.

That means you are spending $16 for a $2 pineapple!

#2. Diapers

It makes sense why people buy diapers at the supermarket.

It saves you time from driving to another store.

But rarely are the best deals on diapers at the grocery store.

This is usually due to quantity.

You can get much bigger boxes of diapers at Target, wholesale clubs and online than at the grocery store.

As a result, the price per diaper is a lot cheaper.

There are some exceptions to this rule, but in most cases, skip the supermarket and buy diapers elsewhere.

#3. Household Items

This one is simply trying to get you to make impulse buys, like with the candy and magazines at the checkout line.

Most of the time you will get better deals by shopping for houseware items at other stores like Target, Walmart or Ikea.

Don’t even enter the section of the store as you may be tempted to purchase something. Just skip it completely.

#4. Office Supplies

Skip the aisle with office supplies as you can get these items much cheaper at Walmart, Target, or Amazon.

I know it will save you time buying at the grocery store since you are already there, but you will pay a premium for doing so.

#5. Frozen Rice

This one falls under the convenience factor like precut produce.

A bag of frozen rice that is a serving of 2 costs me $1.00.

Not bad you think.

But a box of rice that has more than double the number of services costs just $1.99.

Save your money and get the box of rice.

#6. Prepackaged Snacks

The last item on the list is prepackaged snacks.

Again, it all comes down to convenience.

By having someone else do the work for you, you pay a premium.

To save money, buy a large bag of snacks and portion it out yourself.

If you have kids, this can be a fun activity to do together.

Not only will you create memories, but you will save money too.

Use Technology To Your Advantage

If you ever wondered about how to spend less on groceries with coupons then this is your answer.

You have a few options to saving money on groceries using coupons.

- Use traditional coupons found in newspapers

- Follow your favorite brands on social media for coupons and promotions

- Sign up for emails to be notified of sales

All of these options are great, but if you really want to save money, there is more you can do.

And thanks to technology, it is easier than ever to find savings with coupons.

Digital Coupons

Coupons from the newspaper are great, but you have to pay for the newspaper to get the coupons.

Occasionally, I will get a flier of coupons in the mail, but this is rare.

Luckily, thanks to technology, I can get all of the print coupons digitally.

All I have to do is view the fliers online, highlight the coupons I want, and then print them out.

Then I can scan them as the supermarket like a traditional coupon.

Below are the links to the best coupon sites that I get my coupons from.

- Coupons.com: Click here for all the Coupons.com coupons

- MySavings: Click here to see all the MySavings coupons

- SavingStar: Click here for all the SavingStar coupons

- SmartSource: Click here to see all the SmartSource coupons

Store Apps

Your first stop is to download the apps of your favorite grocery stores.

Most nowadays have a section for digital coupons. They work by having you “clip” the coupon on the app by tapping it.

The digital coupon is then added to your virtual wallet and is linked with your store rewards card.

When you go shopping and scan your card, the digital coupon is redeemed and you save money.

I’ve done this multiple times and every time the coupon that I clipped is applied to my purchase.

Ibotta

Ibotta is an amazing app to help you save money whenever you go shopping.

To use it, simply choose the store you want to shop at and see the various offers available.

When you see one you want, you clip it and then go shopping.

After you complete your purchase, you scan your receipt in the app and your savings are credited to your account.

To make it easier, many times you can connect your frequent shopper card so you don’t have to scan the receipt.

What I really like about Ibotta is they offer savings on “any item” purchases.

Instead of having to buy a certain brand of milk, I can earn $0.25 just for purchasing any milk.

They also run bonuses every month too.

If I buy 10 items in a given time period, I can earn up to an additional $10.

As of this writing, I am averaging $20 a month in savings just by using Ibotta.

New users can click the button below and earn a bonus $5 after you scan your first receipt.

Receipt Hog

Receipt Hog is a free app that allows you to earn cash or gift cards for scanning your receipts.

While you won’t be saving money on the things you purchase, you can make some money by scanning your receipts.

After you shop, you scan your receipt and based on the amount of money you spent, you earn coins.

Collect enough coins and you can redeem them for cash through PayPal, Amazon gift cards, or Visa gift cards.

I routinely make $25 every couple of months using Receipt Hog.

Just know you aren’t going to get rich quick with this app.

But it only takes 30 seconds and for me, and getting a free $25 gift card every few months is worth it.

CoinOut

CoinOut is similar to Receipt Hog.

The main difference is instead of getting credited coins for scanning your receipts, you get credited with cash.

The amount you are credited is random and is not based on the amount of money you spent.

Most receipts earn me between $0.01 and $0.05 per scan. Sometimes I get awarded up to $0.15 for a scan.

Again, not a lot of money, but it only takes me 30 seconds to do.

And if you think of all the receipts you get, the money does add up faster than you think.

Click the button below to get started with CoinOut!

Fetch Rewards

This is similar to Receipt Hog.

Simply scan your receipts and earn points. You can redeem your points for gift cards to a ton of different retailers.

A typical shopping trip earns me 25 points per receipt.

But sometimes I buy a partner brand item, like diapers and earn bonus points. This can be anywhere from 50 up to 1,000 points.

Once I get 5,000 points, I can redeem for a $5 gift card.

One trick I do is use Fetch Rewards, CoinOut, and Receipt Hog for the same receipt.

I take a minute and scan the same receipt in both apps and earn money both times.

You can click the button below to download the app. Be sure to enter the promo code 48EPM to earn a sign up bonus of 2,000 points after scanning your first receipt.

Shopkick

Shopkick is a different type of app.

You earn “kicks” for walking into stores, scanning bar codes and buying select items. You can even earn kicks for spending money at some retailers.

Once you earn enough kicks, you can redeem them for gift cards.

The thing I like best about this app is you don’t have to purchase anything to earn kicks.

I simply use the store walk in feature, where I get 50 kicks for walking into a store.

I also like the scan feature.

The scan feature has me scanning the bar codes of various items to earn kicks.

I’ve never spent any money to earn kicks and have earned a couple $25 gift cards in the process.

If you want to try out Shopkick, click the button below. New users get 250 bonus kicks after your first walk in or scan.

Our Groceries

This is simply a shopping list app.

Nothing sexy here, but it does sync with other users.

This is great for families. My wife and I create lists for stores we shop at and then as we need items, we add them to the list.

When one of us is out grocery shopping, we have an up to the minute list of what we need.

There is a free and paid version of the app.

To be honest, I don’t know what the paid version adds to the experience.

If you are simply looking for a shopping list that syncs, the free version is perfect.

Credit Cards

As great as the above options are, there is still another way you can save money at the supermarket.

It is by using the right rewards credit card.

For example, I use my Blue Cash Preferred from American Express.

It offers me 6% cash back at supermarkets, up to $6,000 a year. I regularly earn a few hundred dollars in cash back every year just by using this card.

And I even use another trick to boost my cash back.

I buy gift cards at grocery stores since I earn 6% cash back on these purchases too.

Doing this helped me to score a great deal on a new TV.

Not only was it on sale, but I essentially got another 6% off by buying gift cards to that store from the grocery store.

Another credit card option is the It Card from Discover.

This card offers 5% cash back in rotating categories every quarter.

So for 3 months a year, you can earn 5% cash back on your groceries.

Other than this, invest in a credit card that offers cash back and discounts.

Some cards double as loyalty cards and give you rewards when you purchase from certain stores.

Take Advantage Of Store Brands

A great way to go grocery shopping on a budget is to stay away from name brands and go with generic brands.

You save a lot of money by buying store brand items, which are also known as private label brands.

In fact, some studies showed Americans could reduce their grocery spending by $44 billion just by buying store brand products instead of brand name items.

This can be a bit difficult in the beginning, especially due to a lack of trust some of us have in generic products.

This however, should not be a problem as a quick look at the ingredients list will show you that it is very similar to those in the brand names.

You can even do a comparison between the two to evaluate the difference.

This is what I did a few years ago.

When I bought my first house, I overextended myself and money was beyond tight.

In order to make ends meet, I started to buy store brands.

At first, I was nervous, thinking I was going to be eating lower quality food and not enjoy the taste.

But to my surprise, I never noticed a difference in taste.

And the ingredients were virtually the same.

In fact, there is only one instance where the private label brand item tasted differently than the name brand.

Now I buy most items generic since it is such a cost savings.

Some products you should never purchase name brands of include:

- Sugar

- Flour

- Frozen Vegetables

- Milk

- Meat

- Pasta

- Bleach

- Spices

- Vegetable Oil

- Vinegar

- Nuts

This is just a short list of items you should get the private label version of.

My suggestion for you is to start slow and pick things that you know are virtually the same.

This includes things like frozen vegetables and canned goods and pasta.

Once you see there is no difference other than a fatter wallet, then you can take the next step and start buying more private label items.

How To Save Money On Groceries Without Coupons

This post covered a lot of information on tips to save on groceries.

Many people walk away thinking that the only viable way to save is to use coupons.

But as we’ve shown, there are plenty of way to save money on groceries without coupons.

Here is a quick recap so you can start saving the most money possible.

- Plan meals properly and use leftovers to limit food waste

- Buy less meat

- Avoid impulse buys

- Take your own shopping bags if your store charges for plastic bags

- Stick to your plan and never “over shop”

- Never shop on an empty stomach

- Do not buy snacks, make your own instead

- Reduce visits to a single weekly grocery trip, especially if you go by car, to save on gas

- Count on store sales and promotional offers such as “buy one get one free” to increase your savings

- Always compare prices before you make a decision to purchase

Lastly, I wanted to talk a little more about various sales that you will see at the grocery store.

While sales are a good way to help you save money, the stores do some tricky things to get you to overspend.

Here are a few sales to pay attention to so you can save the most money possible.

#1. Buy One, Get One Free

Many supermarkets will use the buy one, get one free sale, or BOGO.

This sale requires you to purchase 2 of an item. You will pay full price for the first item and get the second one for free.

A variation of this sale is buy one, get two free. This good sale is not as common as buy one, get one free.

When it comes to this grocery deal, make sure you run your numbers. Most times, you will be coming out ahead.

But if another store has lower prices, you might be better off skipping the sale and paying full price at the other store.

For example, I got tricked by this deal.

One store had english muffins on sale, buy 1 get 1 free. I jumped on this deal and bought 2 so I could get 2 free.

But I didn’t check prices first.

If I did, I would have saw they were selling packs of muffins for $4.49 each. Other stores were selling them for $2.09 not on sale.

I ended up paying more than if I just paid full price at another store.

#2. 10 For $10 Sales

This sale is tricky because people think they have to buy 10 items to get each one for $1.

But most times this isn’t the case.

Usually, there is no requirement for a certain number of items to be purchased.

Northeast chain Shop-Rite also calls this a Can-Can sale, because canned goods are the most common item for this type of sale.

These promotions can have different dollar values as well. Maybe 10 for $5 or 10 for $15 are the more common ones.

While 10 for $10 sales don’t require that you purchase identical items, usually they are similar, like canned vegetables, or soup.

When it comes to this type of sale, make sure you are only buying the amount you need.

Remember, you typically don’t need to buy 10 to get the discounted price.

Just buy what you need and no more.

#3. Cartbuster Events

Cartbuster events are also known as mix-and-match sales.

Several different brands will be available and any combination of them can be used.

As food conglomerates have gotten larger, they have been able to create cross-brand sales that leave a substantial portion of the store on sale.

Kraft is especially big on cartbuster events.

Typically, these promotions work by requiring a certain number of items to be purchased to get the sale price.

A common cartbuster sale will require you to buy 10 items to save $5, or $0.50 each.

The downside is that you have to buy 10, or else everything is full price.

Food companies use this tactic to get you to buy more, or to buy their brand over another.

Because of this, I tend to avoid these deals.

There is too much work you need to put in and there are too many ways you mess up and end up paying a lot more than you planned.

#4. Sale Price After Spending Limit

This grocery deal is shady if you ask me.

You will see a great sales price, but in order to get it, you need to spend a certain amount of money on other items that total up to a certain dollar amount, usually $10 or $25.

For example, you might see frozen vegetables on special for $0.25. But you need to spend $25 in order to get the frozen vegetables for $0.25 per pack.

This doesn’t mean you can buy $25 worth of frozen vegetables.

It means you need to purchase $25 of other items, like bread, milk, produce, etc.

Once you hit this dollar amount, then the frozen vegetables in your cart will ring up for $0.25 each.

With this deal, you have to pay attention to the fine print.

I’ve gotten burnt a couple times by not paying attention and ended up paying full price for something I thought was on sale.

As with the cartbuster sales, I tend to avoid these now because of the increased chances of blowing my grocery budget.

Wrapping Up

Now that you know how to spend less on groceries and eat healthy, we’re sure you will have no problem saving money.

At the end of the day, it all comes to down to making a plan and doing a little prep work before you go shopping.

If you can do this, you will see your grocery bills slashed and will have more money in your pocket.