THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES FOR MORE INFORMATION

Why do I do this? Because over the long run, it helps me to make sure I am on target to reach my goals.

If you aren’t running an asset allocation review on your investments, you are putting yourself at great risk. In this post, I’ll review why you need to review your asset allocation and provide some tips to make changes to your asset allocation models.

Table of Contents

The Importance Of Reviewing Your Asset Allocation

When you first set out investing, you should create an investment plan and then determine where you are going to invest your money and what percentage of your money will be in stocks versus bonds. Sadly, many investors ignore this step when investing.

This is a problem because you may be taking on too much or too little risk for you goals. Take the last 5 years as an example. The stock market has been crushing it and the bond market has been just steadily moving about.

If you started with a portfolio of 80% stocks and 20% bonds, you might now be closer to 90% stocks and 10% bonds.

This is not good because you may be taking on too much risk. If the stock market crumbles, you will lose more money because you have more allocated to stocks than you are comfortable with. This increases the chance that when you start losing money, you will let fear take over and sell out of the market entirely.

Of course, there is a flip side to this as well. Let’s say the market does crumble and you are left with a 60% stock and 40% bond portfolio. This too is not good because you might not earn the return you need to enjoy a comfortable retirement.

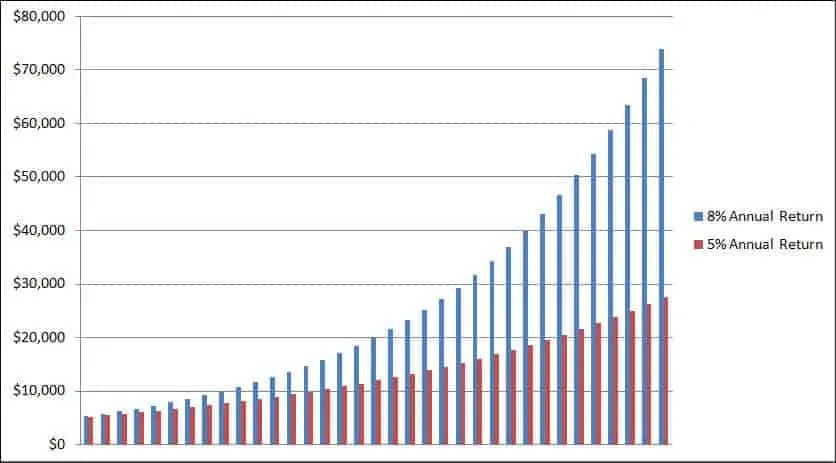

After all, bonds usually return less than stocks. So if you were banking on an annual return of 8% with your 80% stock, 20% bond asset allocation model, you are now looking at maybe a 5-6% return with a 60% stock, 40% bond asset allocation model.

The lower return doesn’t seem like much, but it makes a huge difference in the long run.

Review Your Asset Allocation

You don’t have to be as picky as me when it comes to reviewing your asset allocation. Quarterly is excessive. I just love doing it. You should do it annually. In fact, now is a great time to check. Here are the steps for you figure out your asset allocation:

- Step 1: list out all of your accounts and holdings on a spreadsheet in the first column

- Step 2: Create categories such as large cap growth, large cap value, small cap growth, etc. across the top row. Then list your holdings values in the correct category. If you don’t know where a holding fits, simply go to Morningstar and enter in the ticker symbol. Then scroll down the page a little bit and you will see the classification for your holding. (Note that you can also have Morningstar complete the asset allocation for you using their X-ray tool.)

- Step 3: At the bottom of your sheet, sum up the totals for each category. Then divide by the total amount you have invested in the cell underneath. This will give you your percentage in each category.

- Step 4: Compare these values to your asset allocation in your investment plan and make the needed changes.

Here is a link to the spreadsheet I use. Feel free to use it and make any changes you need so that it works for you.

Making Changes To Your Asset Allocation Model

After you see where you currently stand and how your should be allocated, there is a chance you are off. This is where rebalancing comes into play. Rebalancing is just a fancy way of saying moving money around to get you back to your ideal allocation.

If you are off by more than 5%, you need to rebalance. If you are not off by at least 5%, then you do not need to rebalance.

For example, if your ideal allocation is 80% stocks, 20% bonds, you only rebalance if your stock holdings make up 85% or more of your portfolio or less than 75%. If they make up 82%, you are OK to not rebalance.

So how do you rebalance? There are a few options:

- For retirement accounts, sell out of some holdings and buy into other holdings. This is ideal since gains are not taxed.

- For non-retirement accounts, you want to redirect future contributions. If you sell holdings, you have to pay tax on gains. We don’t want that. So any new money you invest will go into the holdings that are underweight. However, if you aren’t adding new money, then you will have to sell. Another option here is to not have dividends or capital gains be reinvested. When you don’t reinvest, they sit in cash. When it comes time to rebalance, you have cash on hand to invest in the asset classes that you need to add to.

What If You Don’t Have An Asset Allocation Model?

Let’s say you are investing and like the idea of limiting risk while still earning decent returns but have no idea what your asset allocation should be. What do you do then?

To start off creating your asset allocation, you need to take into account your risk tolerance and your age. Years ago, and even some people today, base asset allocation by age. They tell you to take 100 and subtract your age. The answer should be the percent of stock holdings in your asset allocation and the rest should be in bonds.

For example, if you are 40 years old, you take 100 minus 40 to get 60. In this case, 60% of your money should be invested in stocks and 40% invested in bonds. But since we are living longer, people have changed the asset allocation by age by taking 120 minus your age.

Using the same example as above, 120 minus 40 equals 80. In this case, 80% of your money should be in stocks and 20% in bonds.

This is a good starting point, but you need to still take into account your risk tolerance. You can use this great questionnaire from Vanguard to help you get more precise with your asset allocation by age.

Something Else To Consider

If you get married, remember to include your spouse’s holdings into the allocation spreadsheet as well. For some, this will force you to rebalance right off the bat, while for others you may be OK.

When we were married, our allocation was out of whack. I made some changes to my wife’s 401k plan and we had new money invested into bonds because we were too heavily invested in stocks.

Finally, let’s say you don’t want to do all this work. You just want to invest. Is there an option for you? Luckily there is. You can choose to invest with Betterment. In 10 minutes you determine your goal and set up an automatic investment. Betterment takes care of the rest.

They will invest your money in a diversified portfolio and they will rebalance it for you throughout the year. They do charge a small fee for their service but as a client, I can tell you that the fee is more than worth it.

You can open your account here.

Wrapping Up

At the end of the day, making sure your portfolio is allocated the way that makes sense for you is vitally important to your investing success. Any large deviation from this can cause you great harm.

If you don’t want to manually complete your asset allocation, then I highly suggest you try the Morningstar X-ray tool I mentioned above or play around with the asset allocation calculator.

You can also try Personal Capital too. This is the option I started to use recently as opposed to manually updating a spreadsheet. Not only is it free, but your account values update daily so you always know where you stand.

All you do is log into your account and your asset allocation is right there for you, updated in real time. Personal Capital also offers many other great features too.

Click here to open your free account.

If you do chose to go the spreadsheet route, here is the one I use. It is formatted and ready to go. If you are unsure of what your percentages should be for all of the categories, check out Live It Up Without Outliving Your Money. It’s a quick read that breaks everything down for you.

Regardless of the tool you use, keeping an eye on your asset allocation and having the right mix is a critical part to long term success when investing in the stock market. Don’t make the mistake of overlooking your asset allocation.

Great reminder. Asset allocation is a lot like budgeting, it needs to be revisited periodically to take into account what has changed.

yeah, we check out investments every 4 months to see if rebalancing is needed. It is a great way to keep your risk in check.