THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES FOR MORE INFORMATION

Are you tired of barely scraping by, living paycheck to paycheck?

Do you dream about a life of wealth and abundance?

Do you strive to become independently wealthy one day?

You might think the idea of financial independence and becoming independently wealthy is a long shot.

You think your odds of acquiring this amount of wealth are as good as winning the lottery.

Heck, maybe that is why you play the lottery in the first place.

You don’t think it is possible to be financially independent on your own, so you throw out a hope and a prayer that you will hit the Powerball and win $300 million in an instant.

I don’t need to tell you that the odds of winning the Powerball are slim to none.

You know this.

But you play anywhere because there is a chance.

You tell yourself, “somebody has to win”.

And you would rather a chance at winning the lottery than having zero chance at becoming independently wealthy.

But what if I told you that you actually have a much greater chance at becoming financially independent than you do winning the lottery?

What would you think?

That I lost my marbles? I fell off my rocker?

The truth is you can become independently wealthy and I am going to show you how in this post.

Table of Contents

Your Ultimate Cheat Sheet To Become Independently Wealthy

What Does Becoming Financially Independent Mean?

The first step in acquiring wealth and becoming affluent is to define what being independently wealthy means.

It is important that we are on the same page so that you can use the steps in this post to reach your dreams.

Here is what I am talking about when I talk about financial independence. It means that you have enough income producing assets to survive on financially, without having to work.

This doesn’t mean you cannot work.

It just means you don’t have to work a job to survive financially.

You are free to keep working your full time job if it is your purpose in life or you simply love doing it.

Or you could work a part time job doing what you truly love. Or you could choose to not work at all.

When you are independently wealthy, the choice is yours.

Now that we are on the same page, let’s get started with learning how to become financially independent.

How To Become Independently Wealthy In 3 Steps

The path to financial independence is done in 3 simple steps. The image below shows you the process.

Chances are you have heard of the process before.

In fact, it is no secret for how to become independently wealthy.

It’s a very simple process.

The problem is that most people don’t want to do the work involved with achieving this dream.

Remember this dream is more of a reality than you think.

You might be saying that following these steps won’t make you wealthy fast enough or that it is too hard.

Let me clear these concerns up right now.

#1. Nothing is going to make you rich overnight.

Unless you hit the Powerball (odds: slim to none) or you develop the next Facebook (odds: slim), you aren’t getting rich overnight.

And even if you do develop the next Facebook, you aren’t going to become wealthy overnight.

It is going to take years of working 20 hours a day to get it to the point where you can sell it for hundreds of millions of dollars.

At that point, you can wake up the next day after selling the business and talk about how you got rich overnight.

But the truth is you busted your butt for years.

#2. It is not hard to become independently wealthy.

You will have to get uncomfortable for a little bit.

But if you truly want to be financially independent, if this is your ultimate goal, to have complete freedom in life, you will see that the process is not hard at all.

Getting back to the process to achieve this level of wealth, you need to do 3 things.

#1. Slash your expenses

#2. Increase your income

#3. Invest for the long term

The reason for this is simple.

The formula for wealth is simply income less expenses equals wealth.

In order to become wealthy, you need to focus on all parts of the equation. Otherwise you are going to fail.

Here is the next concern I get regarding this plan.

It is going to take me the rest of my life to become independently wealthy.

This is true, if you keep living your life as is.

In fact, you may never even reach anything close to financial independence if you are like most people and overspend and go into debt each month.

But you can become independently wealthy in a short amount of time if you follow this plan.

The Misconception Of Becoming Financially Independent

The reason why so many people give up on this dream or think it is impossible is simple.

They ignore the spending side of the plan.

You probably think you need millions of dollars to become financially independent.

The truth is you can reach your goal with much less than millions of dollars.

How is this possible?

It all comes down to your expenses.

How much you spend each month determines how much money you need to become independently wealthy.

Here is an example.

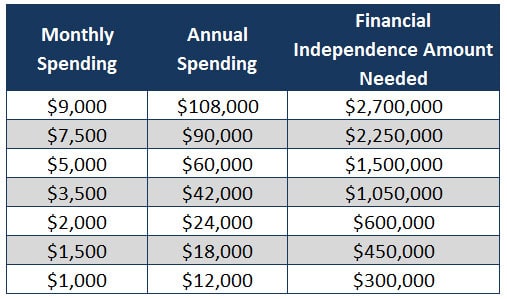

I will use the common rule that says you need 25 times your annual expenses saved to become financially independent.

Let’s say you spend $5,000 a month.

Over the course of a year this comes to $60,000.

If we multiply this by 25, we see that you need $1.5 million to be financially independent.

Here is a chart with more examples.

Notice how much money you need to save if you are spending $9,000 or $7,500 a month?

But look a little closer.

How much money do you need in savings to become independently wealthy if you are only spending $2,000 or $1,500 a month?

A whole heck of a lot less than tens of millions of dollars.

And this leads us to the first step in the process.

Step #1. Slashing Your Expenses

The lower you can get your expenses, the sooner you can become wealthy and financially independent.

This is why this is a key component of any financial freedom journey.

Of course there is a catch here.

You can only drop your expenses down to a certain level.

Anything less than this level and you won’t enjoy life and will rebel against trying to become independently wealthy.

So I want you to pull out your budget.

If you don’t have a budget, here is the easiest solution for you to get started with one.

It’s called Tiller Money.

Just link your accounts and it will pull your transactions into a Google Sheet or Excel spreadsheet.

Then you simply use the drop-down box to categorize them.

After 2 months, you should have a good idea how you are spending your money.

You can get started with Tiller by clicking the link below.

If you already have a budget, then you know these numbers.

Your next step is to look over how you are spending your money.

As you scan through the list ask yourself the following questions:

- Does spending money on this improve my life?

- Does this expense add value to my life?

- Can I be happy without this expense?

Highlight the expenses that don’t meet these criteria and you can live without.

Then cancel the services if you are paying a subscription for or simply stop spending money on them.

Now you are going to look over your list again.

This time I want you ask yourself if there are any lower cost alternatives out there or ways you could save money on these costs.

For example, let’s take a common bill like cable.

You decided you want it keep it because it adds value or improves your life.

But is there a way for you to save some money here?

Maybe move to a lower priced package? Maybe call up your provider and negotiate for a lower price?

Chances are there are things you can do to reduce this expense.

And in reality, there are things you can do for many of your expenses to try to get them lower.

It just takes a little work on your part.

Here are some examples of ways you can lower some of the bigger expenses you have.

I like to focus on these because they give you greater savings for time invested.

What do I mean by this?

If you stop buying your daily coffee, you are saving $3 and you have to make the choice to skip your coffee over and over in order to keep saving $3.

But with the expenses below, you make the choice to lower these bills once. You spend 15 minutes, lower your bill, and you save money every month going forward without any more work.

And the savings can easily be $100 or more a month!

Mortgage

Have you considered refinancing your mortgage?

If you are paying an interest rate of 5% or more, you probably could save money by refinancing.

If your interest rate is lower than that, you could still save money by refinancing.

The trick here though is looking over an amortization schedule.

This is a fancy term for the breakdown of your monthly mortgage payments.

When you refinance, you need to review this to make sure you are saving money.

In some cases, when you refinance you end up paying more money than if you just stuck with your current mortgage.

How is this possible?

When you pay a mortgage, the early months have the majority of your payment going towards interest and a small portion towards principal.

But as you get farther into your mortgage, this switches, and more of your monthly payment goes towards principal and less towards interest.

If you refinance at this point, you extend the loan out and reset things. You begin paying a ton of interest all over again.

This isn’t true 100% of the time, which is why you need to review a breakout of your monthly payments.

Just be sure to ask for the amortization schedule for your current loan and your potential new loan and compare the two.

Property Tax

Most people don’t know they can easily appeal their property tax and save a good amount of money.

We did this and saved ourselves $1,200 the first year and are saving money every year since.

This is because when our taxes go up, they rise slower than before because they are based on a smaller assessment amount.

To appeal your property taxes, reach out to a local real estate attorney.

They will do the work to see if it makes sense to appeal your taxes and if so, they will represent you in court.

If you win, you get a lower tax bill next year. If you lose, your taxes stay the same.

Rarely will your taxes go up, because the attorney would not appeal your taxes if they thought you were underpaying.

If you win your appeal, your attorney will take a fee, which is usually a percent of the first year’s savings, not to exceed a certain dollar amount.

Cable Bill

Here is another big bill for most that seems to keep going up and up.

We have Comcast and they no longer do rolling promotions.

I’ve found the best way to keep my cable bill in check is to agree to a contract.

But before I agree to a contract, I negotiate for the best deal possible.

The trick is to never accept their first offer.

Usually this one pretends to benefit you, but you really aren’t saving much of anything.

This is because they try to trick you with giving you more channels for the same price.

It sounds great to get essentially free channels.

But your goal wasn’t to get more channels at the same price. It was to lower your bill.

Always say thanks but no thanks and ask for another offer.

Usually you will get a better deal.

When I did this recently I knocked $70 off my monthly bill, saving us $840 a year.

Now I know that negotiating isn’t for everyone.

If this is you, try Trim. It’s a service that will negotiate on your behalf.

They tout that they are able to get a reduction 70% of the time and save you $30 a month!

You can try Trim by clicking the link below.

Insurance

Chances are your insurance premiums on your home and cars rise even though you don’t make any claims.

You can thank natural disasters and all the new safety equipment on cars as a contributing factor.

But if you take 15 minutes to get a free quote every few years, you can save serious money.

I shop my insurance coverage every 2 years.

I save on average of $150 when I switch.

Don’t make the same mistake I did thinking my long-time insurance provider was giving me the best deal because I was a loyal customer.

You need to shop around to get a fair price.

I’ve found the easiest way to do this is with Jerry.

After you download the app and enter your name and phone number.

They find your current policy and compare it to up to 45 insurance providers.

You see the best quotes and if you want to switch, just tap on the one you want.

Jerry takes care of the rest.

They save users on average $800 a year on auto insurance.

And the process takes less than a minute.

Click the link below to see how much money you will save.

Electric

The last big bill people face is electric.

Luckily there are some simple things you can do to save money here as well.

Here are my favorites:

- Smart Power Strips: the smart version of power strips kills power to devices when not in use. You might think that all power strips do this, but many gadgets today still draw power even in standby mode. Save money by purchasing a smart power strip. Here is the best one on Amazon.

- Programmable Thermostat: there is no reason to heat or cool your house when you aren’t there. Enter the programmable thermostat. The first generation of these required you to manually program days and times, which quickly became a hassle. But the smart thermostats automatically learn when you are around and adjust the temperature accordingly. Here is the best programmable thermostat you can buy.

- LED Bulbs: the cost of these bulbs is dropping but are still more expensive than incandescent bulbs. They save you money in the long run though by using a fraction of the power for the same amount of light. I recommend you only replace your most used lights first and then replace the rest when you see good sales. Start with where you spend the most time. For many this is your living room, your kitchen and main bathrooms.

This is just a small sample of the things you can do.

For a complete list, check out my post on saving money on electricity.

- Related: Learn the best ways to cut your electric bill in half

- Related: Click to learn how to lower your summer electric bill

After you look over and reduce your big monthly expenses, you can take some time to focus on your smaller expenses.

This is all about making smarter spending decisions.

What helped me the most here is to understand what adds value to my life.

I value spending time with friends and family, so I spend my money on these things.

I am less tempted to buy the hot new electronic gadget because I know it won’t add any value to my life.

Figure out what matters to you and you can begin to easily slash some of your smaller expenses.

- Related: Learn 61 things you waste money on

- Related: Click to learn how to slash your grocery bill

- Related: Find over 50 fun free things to do

- Related: Learn how to get free gas

The goal for this first step is to lower your monthly expenses as much as you can, but still enjoy life.

Remember I am not asking you to drop your spending to $500 a month and wake up hating life.

But there are a lot of things you are spending your money on that don’t add any value to your life.

You can easily give these things up and not miss them one bit.

Once you complete this step, I want you to track your spending again for 2 more months and see where you stand.

Now comes the fun part.

Take the amount you were spending per month and multiply it by 12. Then take that answer and multiply it by 25.

This was the amount of savings you needed to be independently wealthy.

Now take your new monthly spending amount and multiply this by 12. Then take this number and multiply it by 25.

How much do you now need in savings to be independently wealthy?

Here is what happened for me.

We were spending over $6,000 a month, or $72,000 a year. We needed close to $2 million to be financially independent.

After ending expenses on things that didn’t add value to our lives and reducing some other bills, we dropped our monthly spending to $4,800 a month, or $57,600 a year.

We now needed $1.4 million to be financially independent.

We just saved ourselves from needing to save an additional $600,000!

The crazy part is seeing this motivated us to look over our spending again and lower things by another $500, dropping our independently wealthy number down to $1.3 million.

Even now, we are more conscious spenders and work to lower our expenses on a regular basis.

Now that we have looked at your expenses, we need to look at the other side of the equation, income.

Step #2: Increasing Income

We have looked over our expenses and reduced them to a manageable level.

Now it is time to look over our income.

The best way to become financially independent is to diversify your income.

This means you need to have multiple streams of income.

Picture the money you save and spend as a lake.

Then think of your main income source, your career, as a river. Your river flows into the lake, keeping water in the lake.

As long as you are earning steady paychecks, everything is good.

But then the economy tanks and you lose your job.

As a result, you are now living on a your savings. Your mighty river dries up.

With no water flowing into your lake, the levels drop and it begins to run dry.

Everything in your life begins to suffer and your finances quickly unravel.

But what if you have other sources of income?

Instead of your career being the only source feeding the lake, what if you had your career and two side hustles feeding your lake.

Now if you lost your job, you could still survive as you would have your side hustles providing some income for the lake.

The point is, the more income streams you have, the smaller the impact if one of the streams dries up.

So how do you find ways to improve your income flows?

Thanks to technology, there are many options out there for you.

Some will bring in a little extra income, like a couple hundred a month, while others could potentially earn you $1,000 a month or more.

Here are some ideas for you to look into for earning more money.

Note that none of these require you to work an additional 40 hours a week.

You can choose how much you want to work and your income will be a reflection of the time you work.

The nice thing about these ideas is if you pick the right ones, they won’t feel like work at all.

As a result, you will enjoy doing them and earning money at the same time.

Best Ways To Earn Additional Income

Surveys

Surveys are easy to take and for many people, fun at the same time.

You can easily take them during your lunch break, before you go to bed at night, or on a lazy Sunday afternoon.

Most will pay you between $2-$5 for 10-15 minutes of work. That comes out to $12-$20 an hour.

How do you get started? Click on the link below as I walk you through the tricks I use to earn the most money.

For most reading this, taking surveys will bring in around $100 a month.

I typically opt for gift cards and then use these to pay for presents around the holidays.

It’s a simple way to keep my expenses low all year long.

Amazon FBA

Reselling on Amazon can make you a lot of money.

A few years ago, when I was making extra money with Amazon FBA, I was earning an extra $500 a month.

The downside is it can be tricky to get started.

The first 2 months I was making some money, but nothing noteworthy.

And I was losing money on many things I was selling.

But once I got the hang of things, I really started making some steady income.

Luckily, you don’t have to go through the learning process like I did.

Below is a link to a free guide that will get you started making money on Amazon FBA quickly.

FlexJobs

FlexJobs is an online job portal that posts remote work.

Some of the job listings are full time, but many are part time.

And the fact that you can work remotely is a great bonus.

There are all sorts of jobs listed in most categories, so this is a good option for most people to check out.

You never know, you might find a better job that let’s you work remotely!

Click on the link below to get started.

If none of these sounds interesting to you, there are plenty of other options out there.

You can read the posts below to get some ideas.

- Related: See 21 ways you can start making money online

- Related: Learn how to make money with photography

- Related: How to make more money as a waiter

And this is just the tip of the iceberg.

There are many more ways to make money with side hustles.

Alternatively, I recommend you spend 20 minutes writing down the things you enjoy doing and then see if there are ways you can earn some money doing them.

Chances are you can make money with your idea.

You just have to take the first step and start.

And during this time, we won’t forget about your career either.

This is because you can increase your income through your career too.

There are two ways to increase your income from your career.

#1. Become valuable

#2. Become a disruptor

Let’s look at each of these in detail.

Become Valuable

When you become valuable to your boss, you have the potential of earning higher raises.

Here is how this process works.

Find ways to take on more work from your boss.

You might be saying, wait, I already have enough work!

The reality is for many people, if you prioritized better and became more efficient, you would find the work load you have only equals around 30 hours worth of work.

Be honest with yourself for a minute and think about your day.

How much time do you waste? When I did this, I was amazed.

I frequently took water cooler breaks that turned into 15 minute conversations with others.

I would just happen to stop by a friend’s office on my way back from the restroom.

And I would get lost on the internet a few times a day.

Once I became more efficient with my time, I got my work done a lot quicker.

This allowed me to ask my boss for more work.

By taking work off his plate, I made his job easier.

In time, when projects came up, I was the first person he reached out to.

As this was happening, I was taking notes on how I was going above and beyond my job description.

When I had a good amount of additional responsibilities, I scheduled a meeting.

In this meeting I presented my accomplishments and how I was deserving of a larger than usual raise.

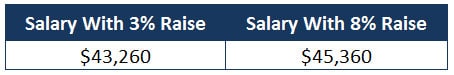

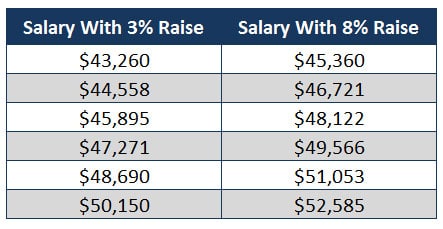

A week after the meeting, he informed me that I was getting an 8% raise!

There are a couple of keys here:

- You have to be taking on more responsibility and completing tasks on time and with high quality

- You can’t wait for your annual review to discuss a raise as the budget is already set

- You have to keep delivering after your raise

Those are the steps to becoming valuable.

You will be working harder, but if you want to become financially independent, it is more than worth it.

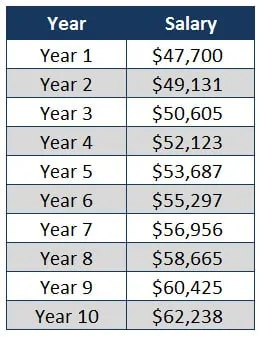

Just look at my salary with that raise versus the standard 3% cost of living raise.

And this doesn’t even take into account the standard 3% raise each year after my large raise.

Here is what this looks like.

Thanks to that raise I was earning close to $2,500 a year more than I otherwise would have.

Become A Disruptor

The next way you can increase your income at your career is to become a disruptor.

When you go this route, you have the option of negotiating for a higher raise or for getting a percentage of the savings, which could be huge.

Here is how this works.

Get to know every single detail about how your department runs.

Write everything down and then begin to look for ways you can save your company money.

When you come up with an idea, start looking into it in greater detail.

Figure out how much the company could realistically save by implementing it.

Once you have this figured out, create a short one page summary.

Talk about how you are doing things currently and how much it is costing you.

Then talk about the new way and how much money it will save the company. Then forward it to your boss.

As you begin to do this, keep detailed notes about the processes you’ve improved upon.

After you have a couple of ideas that have saved the company money, reach out to your boss for a meeting.

In this meeting, discuss how you deserve a larger raise for helping the company to save so much money.

I recommend you first get the raise and then get to work on finding more ways to do things better and for a lower cost.

When you come up with your next idea, schedule a meeting with your boss.

Tell her you have another idea but you don’t want to earn a higher raise.

You would rather work out a deal where you earn a 5% or 10% bonus of the first year’s savings.

For example, if your idea saves the company $10,000 this year and you get a 5% bonus based on this amount, you earn $500.

Why would you or your company agree to this?

Odds are the one-time bonus is smaller than a increasing your salary.

This benefits the company and saves them even more money.

For you, you get that money now.

Instead of earning an additional 2% in salary spread out over the course of a year, you get $500 now, which you can invest and grow much faster than if you were to invest your raise.

Now that you know the importance of creating multiple streams of income when it comes to becoming financially independent, it is time to look at the last step of the process, investing your money.

Step #3: Invest Long Term

The last part of the process for becoming independently wealthy is to invest your money for the long term.

Here is how this works.

After you slash your expenses and find new sources of income, you will have a surplus of cash every month.

The larger the gap between your expenses and your income, the more money you can put away, helping you to become independently wealthy.

Now you could put this money into a savings account, but you would only be earning around 1% on this money.

Depending on how much money you need to be financially independent, it could take many decades before you reach your goal.

For example, let’s say you are saving $1,000 a month and put that money into a savings account for 10 years earning 1% annually.

After 10 years, your $120,000 savings is worth $126,207. You made just over $6,000.

While you might be thinking this is good since you didn’t lose any money, you actually lost purchasing power thanks to inflation.

When inflation is at 3%, which it historically is, you can expect the prices for things you buy to rise by this amount every year.

By only earning 1% every year, you are losing purchasing power.

For example, let’s say a gallon of milk costs $4 today.

At 3% inflation it will cost you $4.12 next year.

If you took $4 and put it into a savings account earning 1%, next year your $4 is worth $4.04.

While you didn’t lose money in terms of your account value, you did fall further behind in terms of affording to pay for things.

In this case, you lost $0.08.

Not huge but remember this is only a gallon of milk. Do the math for all of your expenses and this is a serious amount of money!

The better option is to invest your money in the stock market.

Doing this will help you to grow your money faster and you will reach your goal in a reasonable amount of time.

Take the $1,000 a month savings example from above. Only this time you invest that money every month for 10 years, earning 8% annually.

After 10 years, your $120,000 grew to $187,745. You made close to $68,000!

This gets you much closer to becoming independently wealthy.

I sometimes get push back about investing in the stock market. I get people telling me things like:

- The stock market is rigged

- I can’t make money in the stock market

- I’m too scared to invest in the market

If you follow my guide for investing, you will see that it is not rigged, you can make money, and you don’t need to be scared to invest.

Here is the simple process to investing your money.

#1. Write out an investment plan. This is a document that tells you why you are investing in the first place.

#2. Determine your risk tolerance. You can use an online questionnaire like this one.

#3. Pick low cost mutual funds or exchange traded funds. The fees you pay have a huge impact on your long term wealth.

#4. Invest in these funds every month. Regardless of what the market it doing, keep investing.

That is all you need to do.

I know it sounds simple, but I will admit it isn’t easy.

You will be tempted to stop investing when the market crashes.

You may even get scared and want to sell everything if another crash like 2008 comes along.

But the key to investment success is to stay invested.

Here is a simple example.

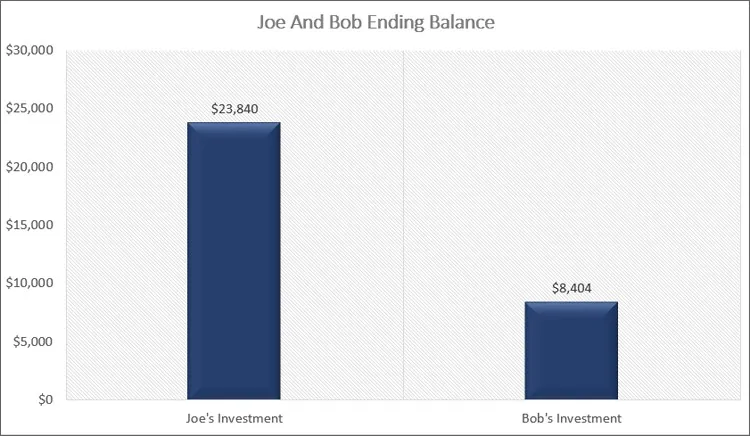

Take Bob and Joe.

They both invested $10,000 at the start of 2007. Then the crash of 2008 hit.

By the end of 2009, Bob had enough and sold everything never to come back.

But Joe stayed invested.

How much money do Bob and Joe have as of the end of 2017?

Bob has just $8,404 while Joe has $23,840.

Joe made everything back and made a lot more. Bob lost money.

You may be saying I cherry picked to make this example work.

This is sort of true.

But the point is, if you stay invested for the long term and don’t sell, you will make money.

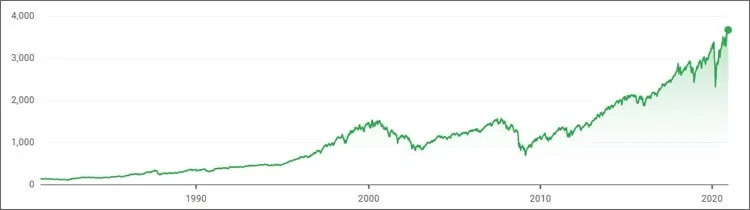

The general trend of the stock market is up. Just look at the below chart.

Yes it drops, but over time, it moves higher.

If you stay invested, you will experience your wealth growing.

And the easiest solution to get started investing and stick with it is to use Betterment.

They make everything I just talked about effortless.

In 10 minutes you will have an account set up and will be investing for the long term.

Once you have your account opened, Betterment will do everything for you to make sure you are limiting your risk and earning the highest return possible.

I highly recommend them.

Click the link below to get started with Betterment.

And if you like the idea of investing, but money is really tight, consider investing with Acorns.

Just like Betterment, Acorns will have you up and investing in less than 10 minutes.

The thing that is different with them however is they round up your purchases and allow you to invest your spare change.

This is a game changer.

Don’t think that your spare change doesn’t add up.

I have readers investing close to $1,000 in spare change alone.

To get started with Acorns and get a $5 bonus, click on the link below.

How To Become Wealthy In 10 Years

Even after reading all this, you might still be thinking it will take you too long to become financially independent.

But I am going to show you how you can become wealthy in just 10 years.

It will require some sacrifices, but they will be worth it if your ultimate goal is to be independently wealthy in 10 years.

Here are the simple steps you need to follow.

To begin, we will assume the following:

- You are earning $45,000 annually

- You have zero saved at the moment

- You are spending $45,000 a year

- Your retirement budget has you spending $18,000 annually (more in this below)

In order to get you to become financially independent in 10 years, you are going to need to have $450,000 saved.

This will allow you to withdraw $18,000 a year to live off of.

To begin, we will first look at your income, specifically your career.

This is because you can earn the most money here.

You start out by finding ways to save your company money.

You are able to find a few ideas that work and discuss with your boss a salary increase.

She agrees and you earn a 6% raise. This takes your annual salary up to $47,700.

In addition to this, you earn a 3% each year thereafter.

Here is your salary over the next 10 years.

You will be saving 100% of this increase and to keep things simple, I am not factoring in taxes.

Next, you decide to take on 2 side hustles to multiply your income streams.

You earn $125 a month taking surveys and earn $750 a month from Amazon FBA.

Just these two side hustles increases your annual income by $10,500 a year, which you save 100% of.

Here is what your income looks like in total over these 10 years.

All of your side hustle income and your salary increases are going into savings.

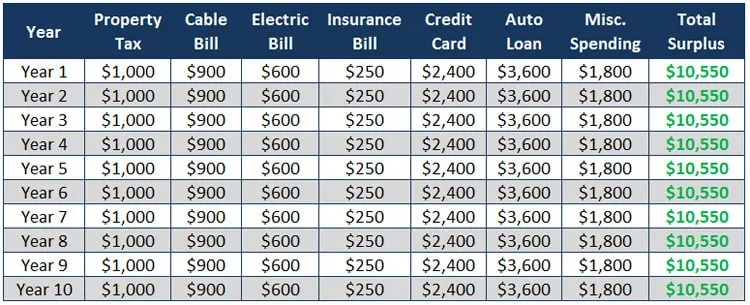

Now we turn to your expenses.

You need to get serious about cutting these back.

We will start with the big expenses I highlighted earlier.

You decide refinancing doesn’t work for you, so you skip it.

But you do challenge your property taxes and get them lowered by $1,000.

Next, you negotiate your cable bill and save $75 a month.

Then, you take some steps to cut back on your electric bill.

By just being smarter about your energy consumption, you save roughly $50 a month.

Finally, you switch insurance companies and save $250 a year.

After attacking your big expenses, you just saved $2,750 a year.

But you also have some debt to eliminate.

Specifically, your credit card debt and your car loan. You can’t be financially independent while being in debt.

Your credit card debt costs you $200 a month, so you pay off your balance and save this amount.

Your auto loan costs you $300 a month.

You sell the car and buy a cheaper used car and save the $300 a month.

Lastly, you look over your budget and decide that there is an additional $150 of stuff you buy every month that doesn’t add value or improve your life.

So you eat out a little less often and stop spending money when you are bored.

In total, you slashed your expenses by $10,550 a year.

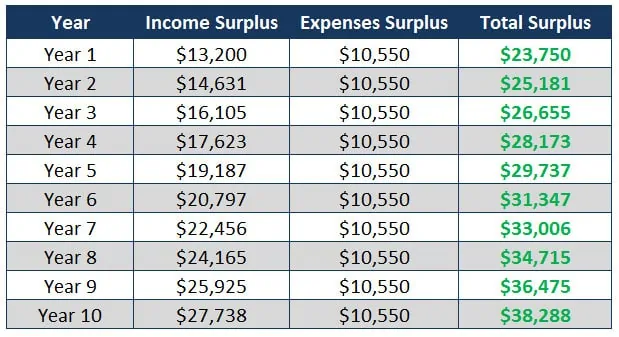

When we add your income and the savings from reduced spending to our chart, you have a surplus of $23,750 for the first year, and that amount grows as you earn your raise each year.

The final step in the process is to start investing your money.

You decide to invest with Betterment since they make investing simple and earn 8% annually.

In 10 years, by investing your surpluses each year, you end up with just over $465,000!

You are officially independently wealthy! And you became wealthy in just 10 years by doing a few things and starting to invest.

Your Steps For Financial Independence

The above example was an extreme one and some of you reading this might be saying it is impossible to live on $18,000 a year.

But many people do it all the time, and many aren’t living poorly.

They are living the life of their dreams.

This is because they know what they value and stopped spending money on everything else.

If cable isn’t valuable to them, they get rid of it.

If owning a luxury car isn’t of value to them, they get rid of it and buy a used car.

They may even sell their house and move into a smaller home or even move to a lower cost of living area.

The point is, their ultimate goal is to be financially independent and they do what they need to do in order to reach their goal.

You don’t have to be as extreme as the example I gave above.

Remember, that was to become wealthy in just 10 years.

The point was to show you that you don’t have to work until you are 70 in order to afford retirement.

And you don’t need $3 million dollars either.

You can achieve financial independence a lot sooner and need a lot less than you think.

You just have to follow the plan I presented.

Frequently Asked Questions

I get a lot of people who get excited about how to become wealthy and end up having questions.

Below are the most common questions I get asked.

This is a great place to start if you are short on time.

What does it mean to be independently wealthy?

When you are independently wealthy, it simply means you no longer have to work in order to survive financially.

You can live off your savings and investments for the rest of your life without worry.

How can I become financially independent?

The way to succeed is to keep your expenses low and save as much money as you can.

This doesn’t mean you need to have millions of dollars saved.

Every person will have a different savings requirement.

For example, if you live on $20,000 a year, you need around $500,000 in savings.

And if you live on $60,000 a year, you need $1,500,000 in savings.

You can use the strategies I mention in this post to increase your income and lower your expenses so financial freedom is possible for you.

What are careers that make you wealthy?

Many people think that you need to go into law or medicine in order to become wealthy.

While having a high salary does help, it is not a requirement.

In fact, going into these careers means high student loan debt you must repay.

This only delays you building wealth.

But don’t take this to mean you should avoid these careers. They are very good careers.

But for the best careers, pick ones that aren’t easily replaced by machines.

These tend to be higher skilled professions.

The reason I suggest this is because you don’t want to be jumping around from job to job.

You want a steady income.

Once you have your career picked and have a job, make sure to save as much money as possible as this is one of the most important parts of building wealth.

Wrapping Up

At the end of the day, you can become independently wealthy.

But you will not do so overnight. It will take time.

But if you follow the process I laid out, it can happen for you.

Now you just have to take that first step.

Daydream for a couple minutes about what life would be like if you were financially independent.

What would your days look like? What would you do? Who would you spend time with?

Now start to make this dream a reality.

Start by cutting back on a couple expenses. Then figure out some simple things you can do to earn more money.

You don’t have to work 80 hours a week. You just have to figure out some ways to bring in additional income.

Then you invest.

In time, your wealth will grow and every year, you will be getting closer to becoming independently wealthy.