THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES FOR MORE INFORMATION

You might think that the only real option out there is for you to make extra payments every month.

But there is another option. It is one I am using to pay off my 30 year mortgage early by 13 years.

And I am not making any extra payments to my mortgage company.

How is this possible?

In this post, you will learn the trick I am using to pay off my mortgage early.

And by using this trick, I am going to have thousands of dollars left over that I can do whatever I want with.

Here are the details so you too can start to pay off your mortgage early without paying extra money each month to your mortgage company.

Table of Contents

How To Pay Off Your Mortgage Early Without Making Extra Payments

My Strategy To Pay Off My Mortgage Early

Here is how I am going about paying off my mortgage early without actually paying any extra money.

Instead of putting extra to my mortgage every month, I simply invest the money instead. The goal is in the future, I will use this built up pile of money to pay off my mortgage.

Here are the details for how this works.

#1. Pick Your Pay Off Date

The first step to this process is deciding when you want to pay off your mortgage. This shouldn’t be a random date, but should have some meaning to you.

For example, my wife and I want to retire at 55. So our mortgage pay off goal is when we turn 55 years old.

Do you want to retire early? Are you trying to get rid of your mortgage before your kids go to college?

You have to decide what date makes the most sense and has meaning to you.

#2. Determine Your Outstanding Balance

The next step is to figure out what your mortgage balance is going to be at your pay off date.

To do this, just use a mortgage amortization schedule. You can find many free ones online. Here is the one I use.

Just enter in the details of your mortgage and then verify that what it says your monthly payment should be is what you pay.

Then scroll down to your current month and verify your statement balance matches what the amortization schedule says.

In some cases, they might differ by a few cents. This is OK.

For us, when we hit 55 years old, our outstanding mortgage balance will be $200,000. This is the amount we need in our investment account by age 55.

#3. Estimate How Much To Save

Now that you know your pay off date and your mortgage balance at the time, you need to figure out how much you need to save.

This step involves a little work, but it is worth it.

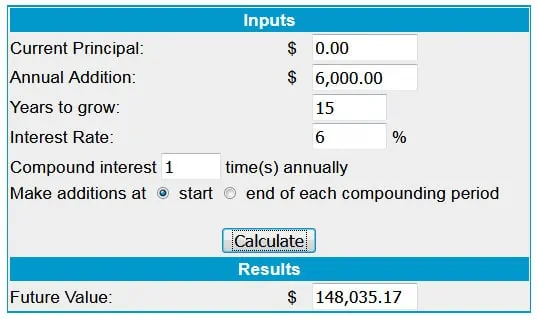

I use this great calculator to get an estimate for us. Here are the steps to using it. Note that I will be rounding numbers to keep this easier to follow.

- Enter ‘0’ for current principal

- Take your goal date minus the current date and enter this into the years to grow field. For us this is 55 minus 40. The 55 is our age when we want to have the house paid off and 40 is our current age. Therefore we enter 15

- Enter in an interest rate. Historically the stock market earns 8% annually. To be conservative, we use 6%.

The only other entry to make is the annual addition field. Here you will play around with numbers and hit calculate until you get a result that matches your goal.

For example, we want the result to be $200,000. We first enter $6,000 in the annual addition field.

The result is $148,035. We need to increase our number.

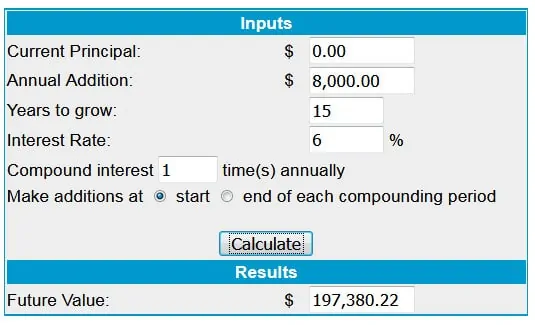

We enter $8,000 and see that the result is $197,380.

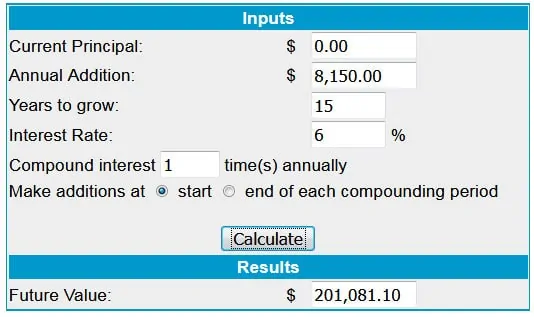

We fine tune our number until we get to $8,150. This gives us an ending amount of $201,081.

We then take the annual number and divide by 12 to figure out how much we need to save every month.

In our example, $8,150 annually comes to $679 a month.

#4. Review And Adjust

In some cases, you might find your answer is one you cannot afford. If we were starting out today with this goal, we would have to make adjustments.

Even with adjusting our spending, we might not be able to save an additional $679 a month.

But in our case, we have been at this for a few years now, so our actual monthly number is more manageable.

If you decide that you can afford the monthly savings amount, great! It is time to get started with saving your money.

If not, then make some adjustments and then get started.

By tweaking your goal date a little bit and adjusting your spending, you should be able to reach your goal without much issue.

Once you do get started, it is important to review your progress.

This is because while 6-8% average annual growth is expected for the stock market, it doesn’t mean it will happen.

So make sure each year you go back to that calculator and update it.

Here is how this will look. To keep things simple, I’ll use the same numbers as before and assume we are saving $679 a month.

After the first year, we enter the following into the calculator.

- Enter your current investment balance. We enter $8,825 because our monthly savings grew a little more than the 6% we were estimating.

- Enter your annual addition amount. Here it is still $8,150.

- For years to grow, you will reduce this number by 1 since you are one year closer to your goal. In our case it is now 14.

- For the interest rate, we will keep it at 6%.

The result is an ending balance of $201,501. We are still on track to hit our goal.

If you find you are short of your goal or are thinking of making adjustments, keep reading as I detail the advantages and disadvantages of this below.

#5. Get Started

Now that you have your monthly savings amount, it is time to get started. Your first step is to decide how you are investing your money.

I’ll assume that for you, your goal is more than 5 years away. In this case, you want to invest your monthly savings amount in the stock market.

Doing this will allow you to grow your money faster. But you have to be disciplined.

You don’t want a lot of risk with this money. Because of this, I encourage you to use a balanced investment approach.

This simply means you will invest your money by putting 60% into stocks and 40% in bonds. Some balanced funds might have you in 50% stocks and 50% bonds. This is OK.

Going this route will limit your growth, but it will also protect your money when the market drops.

You can go about this in one of two ways. You can pick a balanced mutual fund yourself, or you can invest in a balanced portfolio of ETFs with a robo-advisor.

Which one is right for you? If you are really into investing and managing your money, then I suggest you pick a balanced mutual fund.

The one I use the Schwab Balanced Fund (SWOBX). You can get started with just $100 and with online access, you can set up a monthly investment and see your balances easily.

If you aren’t that interested in managing your investments, then go with a robo-advisor. All you have to do is set up a monthly investment amount and they will do the rest.

My favorite is Wealthsimple. Not only do they have a great balanced portfolio, but they also offer something else that is great.

When you invest with them, you can decide if you want to take advantage of round ups.

This means that when you spend money, they will round up your purchases and transfer the difference from your checking account to your investment account.

For example, if you spend $24.18 they will transfer $0.82 to your investment account. It sounds like this wouldn’t make a difference, but it does.

In one year, my round ups totaled close to $400!

You can click here to get started with Wealthsimple.

Why Do I Shun Extra Mortgage Payments?

Why don’t I take the simple approach and just pay extra on my mortgage each month?

There are a couple of reasons, which I detail below.

#1. Better return on my money

My interest rate on my mortgage is 3.75%. This is a great low rate. If I make extra payments on my mortgage, I am getting a guaranteed return of 3.75% on my money.

But when I invest my money in the stock market, I can get an average of 8% annually on my money. Granted, this amount is not guaranteed.

Some years I can make more. Other years I can make less. And in some years I can even lose money.

But I know that over the long term, the stock market rises. And I am disciplined enough to stay invested, even when the market gets crazy.

- Related: Learn the simple steps how beginning investors can be successful

- Related: See how you can survive stock market volatility

Because of this, I choose to go with the stock market. For some, they are more comfortable paying extra each month for that guaranteed return. This is fine.

Others might want to invest in the stock market, but their interest rate doesn’t offer this option.

For example, if my interest rate on my mortgage was 5% or higher, I probably would take a different approach.

I might even use a hybrid version where I pay a little extra each month and save money in the stock market.

But because my interest rate is low and I have the tools to be a successful investor, I choose to go this route instead.

#2. Easier access to my money

The other reason I am opting to not make extra payments on my mortgage is to have easier access to my money.

Life happens. Even when you think you have everything figured out, something happens that forces you to either make changes or consider alternatives.

Let’s say I am putting $300 extra towards my mortgage each month and then I lose my job.

While I will be able to survive for a few months living off my emergency fund, once that is exhausted, money will be a huge stress.

If I didn’t pay the extra $300 each month and instead put the money into an investment account, I could use that money if needed to keep me afloat financially until I found a job.

Or what if my wife finds her dream job 1,500 miles away, we need access to cash in order to move?

With it tied up in the house, we might have to put a lot of spending on credit cards and pay high interest charges until we can sell the house and pay off our debt.

Of course in either situation we could also tap our home equity to get cash to survive too. But there is a process to this.

You aren’t getting the money the next day and if you lose your job, you might not even get approved for the loan.

Advantages And Drawbacks

Now that you know why I am not paying extra each month towards my mortgage and instead am saving the money in a dedicated account, let’s look at the advantages and drawbacks of this strategy.

Advantages

Access to cash. As I mentioned earlier, by having the money in an investment account, you can get access to your money easily and use it for things other than your mortgage if needed.

Higher return. Assuming you have an interest rate on your mortgage under 6%, you can potentially get a better return on your money by investing it first.

Flexibility. When you reach your savings goal, you have 2 options. The first is you can withdraw the entire amount and pay off your mortgage full and clear.

The other option is you can use the account to make your mortgage payments. You can either make the regular monthly payment until your mortgage is paid off, or you can pay a little extra each month.

By choosing this route, your money will continue to grow and when your mortgage is paid off, chances are you will still have a healthy account balance left over to do as you please.

Tax deductions. When you pay extra on your mortgage, you are lowering your principal and thus lowering the amount of interest you pay. As your interest paid lowers, the amount you can claim on your taxes to offset against income drops.

By going with my strategy, you can keep your mortgage tax deduction.

Cash flow. In many cases, you will need to save less per month when choosing to put your money into an investment account versus paying extra each month on your principal. This is because of the higher return you can expect to earn.

Drawbacks

Potential loss. When investing in the stock market, you aren’t guaranteed a return like you are when you pay extra each month. Therefore there is a chance that you won’t reach your goal in the time frame you set.

Taxes. Your money will be in an investment account, so you will be paying taxes on dividends and interest. And when you sell the investment, you will owe tax on the capital gains.

Interest. Since you aren’t paying down your mortgage faster with extra payments, you will be paying the full amount of interest on your loan.

Comparing Your Options

Let’s take an example to see how this plays out. Joe has a mortgage he wants to pay off by the time he is 60, which is 5 years early. Here are the numbers of his mortgage.

- $250,000 mortgage

- 10 years in (current balance $196,959)

- 30 year term with 4% interest rate

- $1,193 monthly payment (principal and interest)

Let’s first assume Joe will pay an extra $260 on his mortgage. This will allow him to pay off the loan 5 years early.

By doing this, he will save $23,985 in interest charges.

If he then takes his mortgage payment and the extra $260 and invests this in the stock market, he will end up with $104,185 in 5 years at 6% interest.

On the other hand, Joe decides to not pay the extra each month, but instead saves the money in an investment account.

He uses the calculator mentioned earlier to determine that he needs to save $3,075 a year or $256 a month to reach his goal.

When he does reach his goal, he chooses to pay his mortgage monthly using the balance in his investment account.

So for the next 5 years, he takes $1,193 out of this investment account to pay off his mortgage. At the end of the 5 years, he still has $61,279 in this account.

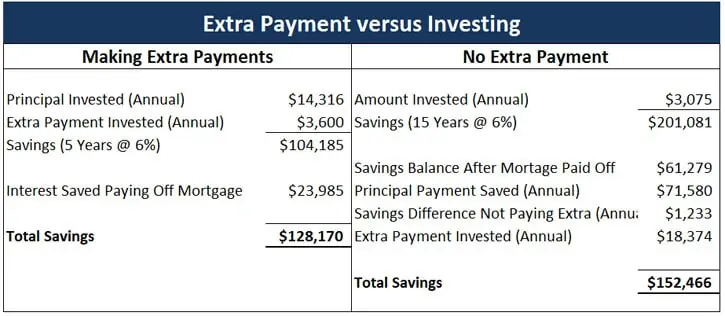

Let’s look at a chart to see the end result of these options.

In the end, by making extra monthly payments, at the end of 30 years, Joe would have $104,185 saved by investing his mortgage payment and the extra amount he was paying each month.

If you add in the interest he saved by paying off his mortgage early, his total savings by going with option is $128,170.

By going with the other option, and using the investment money to pay his mortgage for the final 5 years, he ends up with a balance of $61,279.

But he is also able to invest the $1,193 each month from his budget for the final 5 years and he can save the additional $50 a year for 15 years by not paying extra on his mortgage every month.

Lastly, he won’t be saving any additional money into his investment account, so after 5 years, this is an additional $18,374 in savings.

When you take all this into account, Joe ends up with $152,466 by choosing to invest his money and not make extra mortgage payments.

Comparing the two, Joe ends up with over $24,000 more by investing his money and using this money to pay his mortgage instead of making extra payments each month.

2 Tips To Guarantee Success

Finally, I need to talk about making adjustments to your savings each year. As you know, the stock market doesn’t just go up. It fluctuates up and down.

While earning 6% annually is a safe, conservative estimate, it is not real life. As you review your progress, you will see one of two things happen.

#1. You will be ahead of the game.

If the market gets hot and you earn more than 6%, you will see that you are ahead of the game.

Many people will be tempted to cut back on their savings at this point. Don’t do this! It is a trap. Be thankful that you are ahead, but keep saving your originally planned amount.

The reason for this is simple. Eventually the market will go down. If you stop saving, you are going to find you are actually behind the game.

Now you will have to save more.

In some cases, a lot more.

This is exactly what happened to many pensions. The stock market got hot in the late 1980’s and through the 1990’s.

When the people running the pensions saw how far ahead they were, the corporations decided to stop funding the plans.

Then the 2000’s came and we had close to 0% growth for 10 years. Suddenly, the pensions were behind by hundreds of millions of dollars.

This could have been avoided had the corporations kept funding the plans.

#2. You will fall behind.

If the market gets cold, and you don’t earn 6% or even lose money, you will have make adjustments.

While the market will come back and you could get back on track, it is better to be safe and boost your savings for a short time.

Redo the calculations and see how much you need to save each month going forward to reach your goal.

As long as the new amount is manageable, save it. If it is too much, then decide on the amount that is manageable and save that.

Remember this is only for the short term. Once the market turns around and you calculate your new numbers again, you can adjust back to what you were originally saving and still meet your goal.

Wrapping Up

At the end of the day, picking between these options is a matter of choice. Which one allows you to sleep at night?

This is the answer as to what makes sense for you. My goal was to show you that simply paying more money each month on your mortgage isn’t the only way to go.

Of course, at the end of the day, to make my option work for you, you have to be disciplined and in good financial footing.

You have to keep investing regardless of what the market is doing.

You have to not use this money for a car or a vacation simply because it is there.

And you need to have an emergency fund set up so that when life happens, you can use that money to survive until you get back on your feet.

Doing these things will only increase the odds in your favor to making this a smart financial move.

It doesn’t make sense to invest in bonds that have an interest rate lower than your mortgage. At a mortgage rate of 3.75, I doubt youre finding any bonds to put cash. Would go 100percent stocks until bond rate increase s.

I am not looking higher paying bonds than my mortgage. My money is split 60/40 which offers me an average annual return of 7%. Additionally, while my mortgage is 3.75%, after taking into account the tax write off I get, the effective rate I am paying is closer to 2.8%. I feel confident that my plan will work out in the end.

I think you’re missing the point. Every dollar you put into a bond at a rate lower than your mortgage is earning less than it could by paying down your mortgage. Instead of putting the 40% cash into bonds, you’d be better off taking that cash and paying down your principle then the remainder in stocks.

I agree. But by using my strategy, I keep my cash liquid. So if something comes up, I have cash on hand. If I just throw it all at my mortgage, the money is tied up in the house. The only way I can access the equity is to take out a new loan or line of credit.

If the ultimate goal is to get rid of the mortgage as fast as possible, it is smart to throw everything at it. But I am looking at it from a different perspective.